Discover financial empowerment resources

Discover financial empowerment resources

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

Innovative uses of digital technologies in the delivery of financial education can serve multiple complementary objectives and effectively support the building blocks of financial education. This Guidance was developed to assist policy makers in deciding when to adopt digital delivery, and how to...

Given the scope and the diversity of the reports and studies that examined the impacts of the pandemic on well-being, it can be challenging to absorb and understand all the ways in which quality of life has been affected by COVID-19. The well-being literature offers an approach that may help. This...

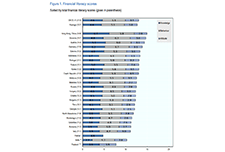

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018...

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with...

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and...

This report responds to a call made by APEC Finance Ministers at their 23rd Ministerial Meeting in Lima in 2016 to advance “the design and implementation of financial literacy policies building on the expertise and standards developed by the OECD International Network on Financial...

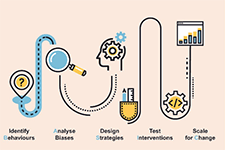

This publication presents key findings for financial education, drawn from the IOSCO/OECD joint report “The Application of Behavioural Insights to Financial Literacy and Investor Education Programmes and Initiatives”. It gives a short overview of the ways in which behavioural insights are...

A better understanding of human behaviour can lead to better policies. If you are looking for a more data-driven and nuanced approach to policy making, then you should consider what actually drives the decisions and behaviours of citizens rather than relying on assumptions of how they should...

The G20 Fukuoka Policy Priorities for Ageing and Financial Inclusion is jointly prepared by the GPFI and the OECD. The document identifies eight priorities to help policy makers, financial service providers, consumers and other actors in the real economy to identify and address the challenges...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to...

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These...

Research shows that many people make poor economic decisions because they are financially illiterate. As we show here, financial ignorance can be expensive and even ruinous, for many. Our goal in this article is to provide an overview of existing work in this important field. We also provide new...

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools...

This book is the first major study of financial education at the international level. It highlights the economic, demographic and policy changes that make financial education increasingly important, identifies and analyses financial literacy surveys in OECD countries, describes the different types...

This is a 2005 brief from the OECD Directorate for Financial and Enterprise Affairs, on recommended principles of financial education. It offers a definition of financial educaiton, financial capacity building, and recommendations for financial education program content....

Asset Building for low–income people through matched savings challenges the focus of traditional poverty-alleviation strategies on income support to enable the poor to escape from poverty and improve their economic and social status. It does not deny the necessity nor the benefits of such support...