Benefits & credits: factsheets from the CRA

The CRA has compiled benefits and credits factsheets for: These are available in English and French.

Canada workers benefit

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility requirements, how to apply and how much you can expect to receive by clicking on the Get It button below.

Community volunteer income tax program (CVITP)

Need help filing your taxes? You may be able to avail of the Community Volunteer Income Tax Program. The Community Volunteer Income Tax Program (CVITP) has existed since 1971 and is a longstanding partnership between the Canada Revenue Agency (CRA), and community organizations and their volunteers. Tax clinic volunteers complete tax and benefit returns for eligible individuals to ensure they receive, or continue to receive, their entitled benefit payments. In Québec, volunteers prepare both the federal and provincial tax return. The CVITP service is offered free of charge to everyone who meets the eligibility criteria, and includes doing taxes for the current and previous years. For the 2022 tax season, community organizations are hosting free in-person and virtual tax clinics.

Canada learning bond for 18 to 20 year olds

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive $500 deposited into your RESP, plus an additional $100 for every subsequent year that you were eligible, up to the age of 15. This money can help cover the costs of tuition, books, tools, transportation, and housing. You do not need to put any money into the RESP to receive the Canada Learning Bond. This single page insert tells you everything you need to know to apply for the Canada learning bond. Disponible en Français.

Ethnography of vulnerable newcomers’ experiences with taxes and benefits

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of this study is to develop the CRA’s understanding of newcomers’ experiences as they first encounter the Canadian tax and benefit system. These findings illuminate potential directions for improving tax and benefit information and services available for newcomers.

Learn about your taxes (free CRA online course)

A free online course to learn about personal income taxes in Canada, developed by the Canada Revenue Agency. Contents include: Additional resources for teachers and facilitators are available.

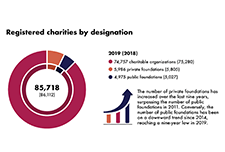

Report on the Charities Program 2018 to 2020

The charitable sector is a major social and economic force, offering vital services to Canadians and people around the world. The Canada Revenue Agency's Charities Directorate employs an education-first approach and client-centric philosophy. It aims to promote compliance with the charity-related income tax legislation and regulations in order to support charitable giving and development of the sector, while protecting charities and the public from abuse. This report provides an update on the Directorate’s activities over the past two years, including the initial impact of the COVID-19 pandemic.

Questions and answers about filing your taxes

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on:

Seniors: tips to help you this tax season

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada resources.

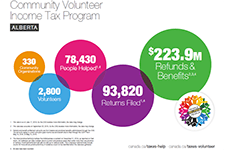

Community Volunteer Income Tax Program (CVITP) provincial snapshots

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les informations sont présentées en anglais et en français.

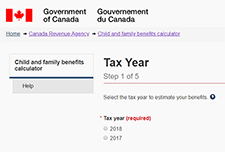

Canada Revenue Agency Child and Family Benefits Calculator

This online tool released by the Canada Revenue Agency can be used to determine the eligibility and payment amounts of child and family benefits. Additional information on child and family benefit programs may be found on the Canada Revenue Agency's child and family benefits page.

The Community Volunteer Income Tax Program (CVITP)

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Stories from the field: Contextualizing the barriers Indigenous People face

In this presentation, Erin Jeffery, Outreach Officer with Canada Revenue Agency (CRA) shares what the CRA Outreach team has learned about tax filing barriers facing Indigeous People in Canada. These barriers include lack of documentation, lack of trust, access to services, and challenges around accessing Canada Child Benefit. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.