Momentum’s Money Management Courses

The money management courses are offered online, on demand, for free. Learn at your own pace and on your own schedule on a variety of topics, including:

Creating Change: Momentum’s Contribution to High-Cost Credit Reform in Alberta

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the financial barriers for people living on low incomes to exit poverty and build sustainable livelihoods.

To evaluate its work for high-cost credit reform in Calgary and Alberta in the period of 2012 to 2019, an outcome harvest was conducted. This evaluation reflects the collective efforts of multiple partners, identifies outcomes achieved as well as Momentum’s contribution to these outcomes.

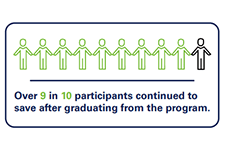

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Online financial tools and calculators (Prosper Canada)

Virtual tools for participant engagement (Prosper Canada)

Online delivery check-list (Momentum)

Jeopardy game template (SEED)

Time-stamps for the video recording:

3:26 – Agenda and introductions

5:10 – Audience polls

8:19 – Virtual delivery considerations (Speaker: Glenna Harris, Prosper Canada)

12:39 – Virtual workshops best practices (Speaker: Fatima Esmail, Momentum)

33:12 – Online money management training (Speaker: Millie Acuna, SEED)

49:07 – Q&A

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

Asset Building: An Effective Poverty-Reduction Strategy

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by and without assets, people are unable to get ahead. At Momentum, we call opportunities to save or invest, Asset Building.

With financial assets, individuals can pay down debt, save more, earn a good credit rating, save for a down payment on a home, and build a sustainable livelihood.

Improving Education Outcomes through Children’s Education Savings

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career expectations, and future financial capability. This brief explains why RESPs are so important, and how parents can use RESPs to save for their children's education.

High-Cost Alternative Financial Services: The Customer Experience

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty Talks! and Sunrise Community Link Resource Centre. The following document summarizes what we learned from these conversations and the loan contracts that borrowers shared with us. It also identifies several themes that emerged from these discussions.

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

High-Cost Alternative Financial Services: Policy Options

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or credit union, access comes at a steep price and with a high degree of risk. On its own, one high-cost loan has the potential to trap a borrower in a cycle of debt, not only amplifying their short-term problem, but also limiting their ability to secure the income and assets needed to thrive in the long term. The policy recommendations presented in this brief, and summarized in the chart on page two, are inspired by the regulatory initiatives across the country, and reflect ways in which all three levels of government can contribute to better consumer protection for all Canadians.

Group RESP Educational Materials

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials here.

The Real Cost of Payday Lending

Since the early 1990s payday lending businesses have become increasingly prolific in most parts of Canada, including Calgary. Social agencies and advocates working to reduce poverty view payday lenders and other fringe financial businesses as problematic for those looking to exit the cycle of poverty. Payday lenders charge interest rates that, when annualized, top 400%. The industry justifies this by stating that comparisons to an annual rate are unfair as loans are not meant to or allowed to last longer than two months. However, the fact remains that these businesses charge far more for credit than mainstream financial institutions and are more prevalent in lower income neighbourhoods.