The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

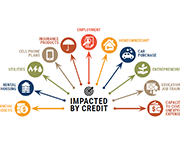

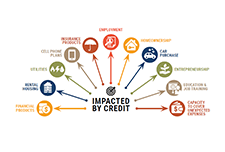

Advancing equity: the power and promise of credit building

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that anyone has access to credit and can build economic security, wealth, and intergenerational transfer. This brief will analyze what is not working within our credit system and identify what philanthropy can do to reimagine a system that builds economic security and mobility for everyone, especially people of color and immigrants. An equitable credit system would create pathways to narrow the racial wealth gap instead of continuing to widen it. Solutions include nonprofit organizations and community A webinar is also available and you can view the webinar slides here.

development financial institutions (CDFIs) delivering financial products that are designed for the people who have been most excluded from the credit system, seeding their journey toward economic security, as well as systemic changes to make economic security and mobility more fairly attainable.

Annual report 2021

AFN's 2021 Annual Report gives a high level review of our work last year, including some snapshots into the place-based initiatives in our regions. Across our regions, AFN is working with grantmakers on collaborative efforts to advance equitable wealth building and economic mobility. One example the Annual Report highlights is the Bay Area Small Business Vulnerability Mapping Project. Last year, Bay Area AFN worked with the Urban Displacement Project to develop an online mapping tool highlighting vulnerable businesses owned by people of color. The multistage process also explores the feasibility of a permanent infrastructure for collecting data, monitoring business health, and recommending policies.

Children’s savings accounts: a core part of the equity agenda

Education after high school, or postsecondary education (PSE), is an important determinant of individuals’ future opportunities, as well as their health and even lifespan. Children’s Savings Accounts (CSAs) are programs that aim to increase access to PSE by building parents’ and children’s educational expectations and a “college-bound identity” starting early in children’s lives. CSAs are a vital part of the equity agenda that remain critically important even as other strategies are put in place to broaden postsecondary access. CSAs programs provide children with savings accounts and financial deposits for the purpose of education after high school or other asset building. CSA program designs, enrollment procedures, and financial incentives vary widely across the U.S. CSAs have been flourishing at the local, city, and state levels over the past two decades. CSAs’ unique value comes down to programs’ financial investment in children coupled with their capacity to bring children and families into frequent contact with information about planning for PSE, savings, and high expectations for the future.

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

Intersectionality and Economic Justice

Widespread financial precarity for women of color with disabilities existed before the pandemic. Rooted in existing systemic inequities, COVID worsened the situation and created new access barriers. Race, gender, and disability impact financial stability in complex ways. Having a disability may increase living costs and limit economic opportunities. At the same time, women of color face significant disparities in education, income, employment, financial services, and wealth. Faced with institutional barriers that limit earning and wealth building, disabled women of color are more likely to be unbanked, use alternative financial services, have medical debt, lack access to affordable health care, and experience food insecurity. Given these challenges and the dire need to address them, this webinar explored:

Investing in Financial Coaching with a Racial Equity Lens

In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through background information, case stories, and key investment considerations, this brief focuses on financial coaching with a racial equity lens as an important strategy for helping people of color achieve equitable outcomes.

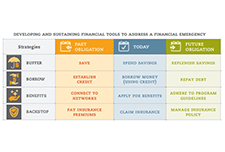

Achieving Financial Resilience in the Face of Financial Setbacks

Financial shocks like these happen to financially vulnerable families every day. Such shocks destabilize household finances and can create hardships that threaten overall well-being. Having tools to manage financial emergencies is critical for people’s long-run financial security. The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Clipped Wings: Closing the Wealth Gap for Millennial Women

AFN’s latest report, in collaboration with the Closing the Women’s Wealth Gap (CWWG) and the Insight Center for Community Economic Development reveals the current economic reality for millennial women and the primary drivers contributing to their wealth inequities. The report, Clipped Wings: Closing the Wealth Gap for Millennial Women is the second in a series of publications that builds off AFN’s 2015 publication, Women & Wealth, exploring how the gender wealth gap impacts women.

From Surviving to Thriving – Ensuring the Golden Years Remain Golden for Older Women

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age financially secure and with dignity. This publication is the fourth in a series of briefs that build on AFN’s publication, Women & Wealth, to explore how the gender wealth gap impacts women, particularly low-income women and women of color, throughout their life cycle, and provides responsive strategies and best practices that funders can employ to create greater economic security for women.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

Achieving financial resilience in the face of financial setbacks

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics:

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

Wealth and Health Equity: Investing in Structural Change

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: On September 29th, AFN hosted a webinar to release the paper with featured speakers: Dr. Annie Harper, Ph.D., Program for Recovery and Community Health, Yale School of Medicine

Joelle-Jude Fontaine, Sr. Program Officer, Human Services, The Kresge Foundation

Dedrick Asante-Muhammad, Chief of Race, Wealth, and Community, National Community Reinvestment Coalition

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Expert Insights: Preventing Evictions in Communities of Color During COVID-19

COVID-19 is radically reshaping many aspects of people’s financial health in America, including their housing security. The economic fallout is disproportionately impacting communities of color due to systemic inequities related to race, housing, employment, and more. As the protections put in place at the start of the pandemic fade away, the United States are facing an eviction tsunami that will disparately displace Black and Latinx families. On August 25, AFN’s summer Expert Insights briefed attendees on rental risks and evictions related to COVID-19. Speakers were Solomon Greene with The Urban Institute and Dr. Christie Cade of NeighborWorks America.

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work enviroment.

Advancing Health and Wealth Integration in the Earliest Years

Despite the well-documented connection between health and wealth, investing in this intersection is still a new approach for many grantmakers. With the goal of inspiring increased philanthropic attention, exploration, and replication, this new spotlight elevates responsive philanthropic strategies that support both health and wealth. This report focuses on the in utero-toddler stage of the life cycle (0-3 years). This age segment has some health-wealth integration activity, primarily through two-generation approaches. The goal is to inspire more philanthropic investment for this cohort by highlighting research and examples and offering recommendations.

Client Engagement and Retention—The Secret Ingredient in Successful Financial Capability Programs

Grantmakers and practitioners recognize the importance of financial security for individuals and families, and many organizations therefore offer financial capability programs aimed at strengthening the financial well-being of the people they serve. But good financial capability programs are often high-touch and costly to provide for program administrators, and time consuming for clients to participate in. To benefit fully from such programs’ offerings, clients must actively participate in the program’s coaching, counseling, or other sessions, and engage in related activities to boost their financial health. Thus, understanding what drives client engagement is critical to helping programs improve program retention and outcomes, and concurrently, helps funders maximize the value of philanthropic dollars and customers’ time. Grantmakers concerned about best practices for funding effective financial capability efforts must therefore understand the vital role of client retention and the strategies for supporting the nonprofit sector to address this challenge. The brief explains the importance of client retention and engagement for financial capability program success, describes three key barriers to effective program participation, offers strategies to overcome those barriers, and closes with recommendations for philanthropy.

Supporting Employee Financial Stability: How Philanthropy Catalyzes Workplace Financial Coaching Programs

More than half of all employees in the United States report that they are This report describes different workplace models, the common characteristics and challenges of programs, and provides recommendations for funders who want to invest in workplace approaches to help workers achieve financial stability.

financially stressed, and nearly one in three employees reports being distracted by personal financial issues while at work. This financial stress impacts individuals’ health, relationships, productivity, and time away from work.