Debt got you down?

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling financially. Take a short “Yes” or “No” quiz to find out if you need support managing money and debt. See how you compare with other quiz respondents.

Quarterly Consumer Credit Trends: Recent trends in debt settlement and credit counseling

This report used a longitudinal, nationally-representative sample of approximately five million de-identified credit records maintained by one of the three nationwide consumer reporting agencies. Trends in debt settlement and credit counseling during the Great Recession and in recent years are presented. This report shows that nearly one in thirteen consumers with a credit record had at least one account settled through a creditor or had account payments managed by a credit counseling agency from 2007 through 2019. Since 2016, the number of debt settlements has increased steadily, while credit counseling numbers are relatively unchanged.

Enterprise Communities Plus: A network of financial capability services in low-income housing developments in New York City

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and moderate-income people through affordable housing in diverse, thriving communities. The pilot program seeks to develop a network of service providers dedicated to supporting the housing developments and introduce rent reporting for credit building and matched savings accounts to residents. Prosperity Now joined the implementation process in May 2018.

In this brief, we provide some initial information on the participants that currently are enrolled in the program and some lessons learned to guide other organizations in their efforts to provide financial capability services into housing programs.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

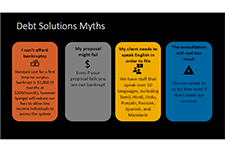

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A