Financial consumer protection framework

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional promotional toolkits can be found on the FCAC website.

FCAC new consumer information – electronic alerts

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the new and enhanced protections in Canada’s Financial Consumer Protection Framework (the Framework) that comes into effect on June 30, 2022. To inform Canadians about electronic alerts and their benefits, the Financial Consumer Agency of Canada (FCAC) published new consumer information on electronic alerts, developed an infographic, and prepared social media content that you can use on your own social media channels. Under the Framework, banks will be required to: À compter du 30 juin 2022, les banques seront tenues d’envoyer des alertes électroniques à leurs clients afin de les aider à gérer leurs finances et à éviter de payer inutilement des frais, ce que certaines ont déjà commencé à faire. Ces alertes font partie des mesures de protection nouvelles ou améliorées prévues dans le Cadre de protection des consommateurs de produits et services financiers du Canada (le Cadre) qui entre en vigueur le 30 juin 2022. Pour informer les Canadiens et les Canadiennes à propos des alertes électroniques et de leurs avantages, l’Agence de la consommation en matière financière du Canada (ACFC) a publié de nouveaux renseignements à ce sujet pour les consommateurs. Elle a également créé une infographie et préparé du contenu pour les réseaux sociaux que vous pouvez utiliser dans vos propres comptes de médias sociaux. En vertu des dispositions du Cadre, les banques seront tenues :

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

English

Download in English

French

Download in French

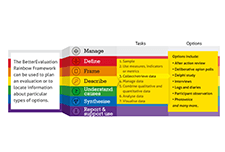

Rainbow Framework

The Rainbow Framework organizes different methods and processes that can be used in monitoring and evaluation. The range of tasks are organised into seven colour-coded clusters: Manage, Define, Frame, Describe, Understand Causes, Synthesise, and Report & Support Use. Users can use the framework to plan an evaluation that covers all necessary tasks or choose from an approach which contains a pre-packaged combination of task options.