Financial Health & Wealth

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money. Money is a big way that others control and influence our lives. Sometimes we need to depend on others to give us money and tell us what to do with money. Opening a bank account, understanding where your money is coming from, and saving money will help you to become financially independent and financially healthy. This report from The Native Women's Association of Canada covers the importance of financial health and has sections on financial information covering bank accounts, insurance, budgeting, saving, credit cards, car loans, income taxes and housing.

Financial wellness guide: questionnaire

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial goals.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

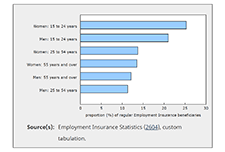

Employment Insurance, February 2021

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and various other public health requirements. Public health measures were relaxed in Quebec, Alberta, Nova Scotia and New Brunswick on February 8, although a curfew remained in effect in Quebec. Measures were loosened in many regions of Ontario on February 10 and 15, although stay-at-home orders remained in place in the health regions of Toronto, Peel, York and North Bay Parry Sound. In Manitoba, various measures were eased on February 12. In contrast, Newfoundland and Labrador reintroduced a lockdown on February 12, requiring the widespread closure of non-essential businesses and services.

The poverty premium: a customer perspective

Fair By Design and Turn2Us (in the United Kingdom) commissioned this research to explore recent changes in the poverty premium landscape, to understand if they are having any impact on the cost of premiums, or the number of people who pay them. Importantly, we did this through the lens of the low-income customer in order to hear first-hand how they experience these extra costs; how they see the problems with the current system; how they respond to initiatives and interventions designed to reduce poverty premiums; and the changes they feel would make the most difference to them and their household. This research report:

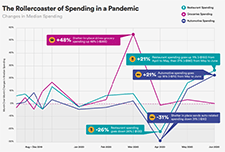

The Economic Toll of COVID-19 on SaverLife Members

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their savings program members during the COVID-19 pandemic from March to August of 2020.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.