English

Investing with interest: tips and tools for maximizing your savings

IWI – Worksheet #1: What do you want to save for?

IWI – Worksheet #2: Tracking your income and expenses

IWI- Worksheet #3: Are you ready to invest?

IWI- Worksheet #4: What can you invest in?

IWI-Worksheet #5: Where can you get advice?

IWI-Worksheet #6: Watch out for investment frauds and scams

IWI-Worksheet #7: Tips for success

Resources

Crypto Quiz, OSC

Grandparent scams and how to avoid them, OSC

Compound interest calculator, OSC

Emergency fund calculator, OSC

Tips to keep your credit card safe, OSC

Investment products, OSC

Types of fraud, OSC

Multilingual financial resources for Ontarians, OSC

Pay down debt or invest tool, OSC

Reporting fraud, OSC

Introduction to investing, OSC

Scam spotter tool, OSC

Your trusted person and why they matter, OSC

Getting Your Money Back; An Investor’s Guide to Navigating Canada’s Complaint System, FAIR Canada

Study explores Canadian attitudes about Crypto, OSC

How the stock market works, OSC

The basics of personal finance, Credit Canada

What is risk tolerance in investing, OSC

Eight common investment scams and how to spot them, OSC

4 signs of investment fraud, OSC

Evolution of the fraud pitch , Canadian Anti Fraud Centre

Saving or investing for short-term goals, OSC

Investor questionnaire, CIRO

Fees matter, MFDA

Fee calculator, OSC

Annual information about your investment fees, OSC

Investing basics, CIRO

The many faces of elder abuse, OSC

How to Read Your Account Statement and the Things to Focus on, CIRO

French

L’intérêt d’investir: Conseils et outils pour maximiser votre épargne

Ressources

Questionnaire sur les cryptoactifs, Commission des valeurs mobilières de l’Ontario

Les arnaques des grands-parents et comment les éviter, Commission des valeurs mobilières de l’Ontario

Calculatrice épargne REER, Commission des valeurs mobilières de l’Ontario

Calculatrice intérêts composés, Commission des valeurs mobilières de l’Ontario

Calculatrice fonds d’urgence, Commission des valeurs mobilières de l’Ontario

Astuces pour garder votre carte de crédit en toute sécurité, Commission des valeurs mobilières de l’Ontario

Produits d’investissement, Commission des valeurs mobilières de l’Ontario

Types de fraude, Commission des valeurs mobilières de l’Ontario

Ressources financières multilingues pour les Ontariennes et les Ontariens, Commission des valeurs mobilières de l’Ontario

Calculatrice rembourser des dettes ou investir, Commission des valeurs mobilières de l’Ontario

Signaler une escroquerie, Commission des valeurs mobilières de l’Ontario

Planification de la retraite, Commission des valeurs mobilières de l’Ontario

Questionnaire préparation des investisseurs, Commission des valeurs mobilières de l’Ontario

Introduction au placement, Commission des valeurs mobilières de l’Ontario

Outil détecteur d’escroquerie, Commission des valeurs mobilières de l’Ontario

Votre personne de confiance et les raisons qui expliquent son importance, Commission des valeurs mobilières de l’Ontario

Une étude explore les attitudes des Canadiens à l’égard de la cryptomonnaie, Commission des valeurs mobilières de l’Ontario

Le fonctionnement de la bourse, Commission des valeurs mobilières de l’Ontario

Académie d’investissement, Commission des valeurs mobilières de l’Ontario

Quelle est votre tolérance au risque en matière d’investissement? CVMO

Huit escroqueries courantes en matière d’investissement et comment les repérer, CVMO

Quatre signes de fraude liée aux placements, CVMO

Bulletin : Évolution des types de fraudes, Centre centreantifraude du Canada

Épargner ou investir pour réaliser des objectifs à court terme, CVMO

Questionnaire de l’investisseur, OCRI

Calculateur de frais, CVMO

Information annuelle sur vos frais de placement, CVMO

Principes de base en matière de placement, OCRI

Choisir un conseiller, OCRI

Les nobreuses facettes de l’exploitation financière envers les personnes âgées, CVMO

Comment lire votre relevé de compte et les éléments particuliers qu’il contient, OCRI

Survey on savings for persons with disabilities

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP. Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability Savings Plan (RDSP)—about 31.5% in 2020. To understand why more eligible residents in Canada do not have an RDSP, Employment and Social Development Canada asked Statistics Canada to conduct the Survey on Savings for Persons with Disabilities. Its goal was to collect data from residents in Canada who were eligible for an RDSP but did not open one. These respondents included both persons with disabilities and family members or others who care for persons with disabilities, since the holder of the plan may not be the same person as the beneficiary in all cases. These data show that, in general, eligible residents in Canada lack information about the RDSP, with many not being aware it exists and a substantial portion reporting not having enough information or money to open one.

Introduction to investing: A primer for new investors

Whether you’re new to investing, or new to Canada, InvestingIntroduction.ca can help. Visit the Ontario Securities Commission's refreshed website and find resources to help you make more informed investment decisions and better protect your money. The information is available in 22 languages.

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the Canadian banking system.

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

Plan Institute Learning Centre

The Plan Institute Learning Centre presents workshops, webinars, publications and other resources for individuals and/or families of a person with a disability, support-care workers, and organizations.

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

RDSP calculator

Enhance the quality of life for a family member with a disability. By answering a few simple questions, the RDSP Calculator can help you project the estimated future value of an RDSP, and the approximate value of future withdrawal payments. Run various scenarios to see how it would affect the value of your RDSP. The RDSP Calculator is a tool to help you assess the potential of opening and contributing to an RDSP. The estimates provided by the Calculator are for information purposes only. The profile of your RDSP may differ from the RDSP Calculator projection.

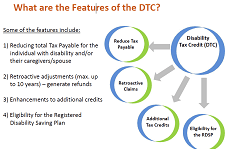

Breaking down barriers: A critical analysis of the Disability Tax Credit and the Registered Disability Savings Plan

The Disability Tax Credit helps Canadians by reducing the amount of income tax they are required to pay. The Registered Disability Savings Plan helps people with a disability or their caregiver save for the future by putting money into a fund that grows tax free until the beneficiary makes a withdrawal. This report, released by the Senate Committee on Social Affairs, Science and Technology, makes 16 recommendations aimed at improving both programs. They are divided into short-term objective to make the process for the two programs simpler and clearer, and a long-term philosophical shift in the way Canada deals with people who are in financial distress but cannot advocate for themselves. Recommendations include removing barriers that prevent people from taking advantage of the Disability Tax Credit and making enrolment in the Registered Disability Savings Plan automatic for eligible people under 60 years of age.