Discover financial empowerment resources

Discover financial empowerment resources

There are many different actions that can be taken to improve financial wellbeing. The Financial Wellbeing Framework offers 17 entry points to action to inform government, organizations, policymakers, decision-makers, practitioners, and researchers in their efforts to address financial...

Receiving a lump sum of money can be overwhelming to some people. Careful planning can help you make the most of your money. Here are some ways to financially prepare for your compensation in the First Nations Child and Family Services and Jordan’s Principle Settlement. Watch the...

If any of these statements sound like something you would say about money, this toolkit is for you: • I don’t have enough money to live on each month. • I find it frustrating to have to share my situation over and over again. • I wish I could find help easily but don’t know where to...

The Navigating Tech Abuse Toolkit is a resource for frontline workers in domestic violence shelters in northern, remote, rural, and Indigenous (RRNI) communities. In this toolkit, you will find a series of conversation guides that you can use when working with survivors. Each guide focuses on a...

November is Financial Literacy Month This year marks the 15th anniversary of Financial Literacy Month (FLM) in Canada. Since 2011, FLM has helped Canadians strengthen their financial knowledge and skills with the goal of improving their financial well-being. Led by the Financial Consumer Agency...

A culturally grounded resource to support Indigenous financial wellness. Braiding Mind, Body, and Spirit is a financial wellness bundle created by and for Indigenous individuals and communities. Developed with Indigenous teachings, community voices, and practical tools to support individuals,...

During the income tax filing season, scammers pose as representatives of the Canada Revenue Agency (CRA) in an attempt to trick you into sending payment for fictious "debts" or into providing sensitive personal information that they can use to commit fraud. Scammers might send you convincing, and...

The CRA has put together a website for what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. This includes information on tax exemption and who is eligible. There is also information on...

The Financial Services Regulatory Authority of Ontario (FSRA) is responsible for protecting the rights of consumers in Ontario by promoting high standards of business conduct and transparency within the financial services they regulate. Financial services professionals are not required to use...

This toolkit, presented by Pathways to Prosperity, features a variety of practices and programs that can be used to address and improve each of the characteristics of a welcoming community, as identified in Toolkit I: Measuring Welcoming Communities. The goal is to mobilize and facilitate the...

Financial literacy in the Black community is crucial for the economic prosperity of Black families across Canada. According to a 2015 report released by the Canadian Center for Policy Alternatives, 60 percent of Black Canadians fell into the bottom half of the national distribution of economic...

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

The Canadian Securities Administrators compiles a list of member investor alerts that is intended to assist the public and the securities industry in conducting due diligence. The subjects of these alerts are persons or companies who appear to be engaging in securities activities that may pose a...

As Nova Scotia’s population gets older, more people are thinking about, and getting closer to retirement, and many of them have built up a sizable investment portfolio over their lifetime. This has led to older adults in Nova Scotia, and throughout Canada, being targeted by investment fraud and...

This guide, prepared by FAIR Canada, will help consumers who have complaints against their bank or investment firm and want to be financially compensated for their losses. This guide provides and overview of external complaint-handling systems that may be available when seeking compensation. It is...

Homelessness among women and gender-diverse people in Canada has been declared by the Federal Housing Advocate a national human rights crisis. This new toolkit will support the evidence- and testimony gathering for the upcoming National Housing Council’s Review Panel on Canada’s Failure to...

Like so many other Ontarians, you may want to work with a financial professional to plan for various financial goals. Knowing who to talk to when seeking financial planning or advisory services can be hard. To give you confidence when seeking advice from anyone using a Financial Planner or...

This collection of financial empowerment tools and resources is intended to support both Indigenous and non-Indigenous organizations working to help Indigenous Peoples navigate the receipt of a lump sum payment. It was created as part of the Expanding investor education and protection for...

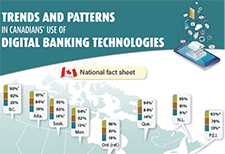

FCAC and Statistics Canada collaborated on fact sheets examining trends in digital banking at the national, provincial and territorial level. This work aims to further financial inclusion by helping identify which groups are most likely to face barriers. It also supports the National Financial...

This toolkit provides: An overview of some solutions that shelter providers can implement to improve their service delivery and processes in a way that upholds the rights and dignity of shelter residents. Helpful resources to support shelter providers, advocates and lived experts in...

This guide by the Canadian Investment Regulatory Organization covers these topics: What are crypto assets? Blockchain technology Cryptocurrencies or crypto assets? Buying and selling crypto assets Alberta securities law for crypto assets and crypto asset trading platforms Holding your...