Discover financial empowerment resources

Discover financial empowerment resources

This 90-minute webinar provides frontline practitioners with foundational knowledge and skills to support Canadians living on a low income in accessing benefits. Participants will learn the importance of access to benefits for individuals and families, review key skills and opportunities for...

This 90-minute webinar provided frontline practitioners with foundational knowledge and skills to support Canadians living on a low income in accessing benefits. Participants learned the importance of access to benefits for individuals and families, reviewed key skills and opportunities for...

In recognition of November 2025 Financial Abuse Awareness month, the Canadian Center for Women's Empowerment (CCFWE) hosted Empowering Survivors Through Digital Safety: Preventing Technology-Facilitated Economic Abuse within Financial Systems. This webinar explores how survivor-informed policy,...

There’s more to the college affordability crisis than the mere fact of debt. “You know, 80% of people with student debt say it causes them to delay things like getting married, buying a house, having kids,” says Aaron Kuecker, president of Trinity Christian College. “Two-thirds of folks who...

The Dollars Seen Differently podcast breaks down financial topics to make them more accessible for people who are blind, Deafblind or have low vision. Hosted by Ryan Hooey, each episode features a down-to-earth conversation with financial experts, offering practical tips and resources on topics...

The Nova Scotia Securities Commission has investor education videos covering a range of topics from recognizing frauds and scams to learning more about investing and compound interest. Access this resource to see them...

In this 8th episode of the "What the Food?!" webinar series, we hear from Randy Hatfield, Executive Director at the Saint John Human Development Council about affording food in today's economy - the living wage vs minimum wage, the Consumer Price Index, rental rates and the salary requirements to...

Fraudsters are master manipulators who leverage relationships to build trust and exploit you financially. Technology makes it easy to become a victim as bad actors can, pretend to be someone you know online, or use artificial intelligence to trick you. According to data from the Canadian Anti-Fraud...

In recent years, social media has become a powerful platform for sharing information. A way to discover new products and lifestyle hacks, everything from gaming to fitness, meal prep, or even finance can be the niche of an online influencer. In today’s digital age, especially post-pandemic, there...

Following the crowd can help you simplify complex decisions like investing. But you could lose money by investing in something just because everyone else is. Find out how to avoid herd behaviour by watching this video from the Ontario Securities...

Having a small emergency fund can alleviate major stress. Putting a few dollars away each month can help you prepare for the unexpected. Watch this new video by the Ontario Securities Commission to learn...

This 60-minute webinar for frontline practitioners, social service providers, and funders shares insights from a two-year project designed to help build financial wellness in isolated and rural First Nation communities in Manitoba and Ontario. Partnerships between First Nation communities and...

This 90-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

Trauma and violence are highly prevalent and have serious impacts on health and well-being. Being aware of how trauma and violence can present during service interactions can improve their effectiveness and client and provider satisfaction and well-being. Financial literacy educators are...

In this video by the Ontario Securities Commission, learn the 4 signs of investment fraud to help you keep your money...

Rental apartment supply increased, but it has not kept up with the growing demand. As a result, vacancy rates have reached record lows while rent prices have soared to record highs. This situation has raised major concerns about the affordability of rental housing. Read the rental market...

Practically everyone today seems to have some form of debt. Whether that’s from student loans or credit cards, debt is a huge issue for Canadians—one that we could all use a little help to get out of. To gain some relief, people all over the world have turned to side hustles and the “gig...

The Aspen Institute Financial Security Program hosted a public event, “Charting a Course Towards a More Inclusive Financial System: Our Collective Call to Action,” on Tuesday, December 5th 2023. At the event changemakers in government, industry, and nonprofits spoke about their role and...

The Future of Wealth Discussion Series consist of 1-hour virtual convenings that are open to the public and bring together leaders across sectors and disciplines to consider wealth-building objectives that Aspen FSP considers critical to creating widespread household financial well-being. Click on...

Drawing on survey and interview data, as well as data from Daily Bread and North York Harvest’s member agencies, the 2022 Who’s Hungry report examines trends in food bank use and food insecurity over the past year in relation to three core areas: income and employment, housing, and the cost of...

The Office of the Superintendent of Bankruptcy (OSB) is continuing its efforts to help Canadians experiencing serious financial difficulties find the right debt solution. These efforts include increasing consumer awareness about the unregulated Debt Advisory Marketplace and helping consumers...

This webinar provides frontline practitioners with recently created tools to support Canadians who are living on a low income to manage their money and learn about saving and investing. Participants will be taken on a guided tour of our new Making the most of your money online course and then...

Searching for government benefits can feel like wading through a huge ocean of information. With so many benefits programs out there, it can be hard to know where to start. This webinar will teach you how to help people seeking ways to boost their incomes and/or reduce their expenses by...

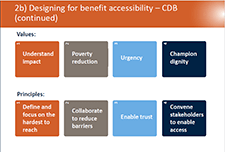

In this webinar you will learn about the barriers facing people with disabilities in accessing benefit programs and the work currently underway to identify, influence and pilot solutions to help advance the access to benefits process now and in the future. This webinar includes: - An...

The ballooning cost of living has had a disproportionate impact on low-income households, 77.6% of whom are financially vulnerable or extremely financially vulnerable. Prosper Canada's recently commissioned study from the Financial Resilience Institute, shows the unarguable deteriorating state of...