Discover financial empowerment resources

Discover financial empowerment resources

This report summarizes the first results from the Canadian Survey on Working Conditions. Explore how different kinds of workers experience core dimensions of quality of employment, including exposure to physical risks, emotional demands, work schedules and hours, time pressures, co-worker support,...

The 2025 Report of the National Advisory Council on Poverty is progress report on 'Opportunity for All' – Canada’s First Poverty Reduction Strategy. It presents views on whom people turn to when they need support, how they access services, and if the existing benefits and programs meet their...

November is Financial Literacy Month This year marks the 15th anniversary of Financial Literacy Month (FLM) in Canada. Since 2011, FLM has helped Canadians strengthen their financial knowledge and skills with the goal of improving their financial well-being. Led by the Financial Consumer Agency...

This Government of Canada dashboard lets you explore trusted data from 2019 onward. Examine trends on how Canadians manage their financial commitments, how they maintain emergency savings, and where...

Housing First involves moving people experiencing homelessness —particularly people experiencing chronic homelessness—rapidly from the street or emergency shelters into stable and long-term housing, with supports. Stable housing provides a platform to deliver services to address issues...

Getting cyber safe doesn't have to be complicated. With the right resources and tools, you can stay safe and secure online. Here's a handy checklist for protecting your data...

The following snapshot aims to highlight how Anti-Black racism and systemic discrimination are key drivers of health inequalities faced by diverse Black Canadian communities. Evidence of institutional discrimination in key determinants of health is also presented, including education, income, and...

In June, we commemorate National Indigenous History Month 2021 to recognize the history, heritage and diversity of First Nations, Inuit and Métis peoples in Canada. The Crow-Indigenous Relations and Northern Affairs Canada website contains resources on Indigenous history, promotional and...

The National Housing Strategy is a 10-year, $70+ billion plan creating a new generation of housing in Canada giving more Canadians a place to call...

The effects of the COVID-19 pandemic have been profound and far-reaching. Beyond endangering the health of Canadians, the pandemic has worsened inequalities among groups of people. Women, girls and gender-diverse people have faced unique challenges during the pandemic. The Committee recommends...

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair,...

In August 2018, the Government of Canada announced Opportunity for All – Canada's First Poverty Reduction Strategy. The Strategy included a commitment to the UN Sustainable Development Goal's target of reducing poverty by 20% by 2020 and 50% by 2030. Opportunity for All included the adoption...

Canada is a prosperous country, yet in 2015 roughly 1 in 8 Canadians lived in poverty. The vision of Opportunity for All – Canada's First Poverty Reduction Strategy is a Canada without poverty, because we all suffer when our fellow citizens are left behind. We are all in this together, from...

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the...

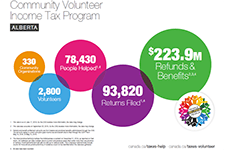

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les...

The Government of Canada has long recognized the need to strengthen financial consumers’ knowledge and decision-making abilities, and has made it a key priority. When more Canadians feel more in control of their finances, the benefits are immediate and potentially far-reaching. In this report,...

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education...

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans...

Answer the questions in this Government of Canada online tool to get a customized list of benefits for which you may be eligible. The Benefits Finder may suggest benefits from federal, provincial or territorial...

Scammers are sneaky and sly. They can target anyone, from youngsters to retirees. They can also target businesses. No one is immune to fraud. Our group of superheroes has found a way to see through the scams. Their secret is simple: knowledge is power! Read this booklet to find out how you can...

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible...

The Government of Canada is committed to strengthening the middle class and helping low-income Canadians exit poverty so that they have sufficient capabilities to be well and do well. To achieve this goal, we will need to form partnerships, modernize the existing landscape of supports and encourage...

This report analyzes federal spending on elementary and secondary education for students living on First Nations reserves. It examines the evolution of spending over the past decade and analyzes how funds were allocated and how these allocations compared to the provinces. It also provides forward...

In June 2005, Social and Enterprise Development Innovations (SEDI), the Policy Research Initiative (PRI), and the Financial Consumer Agency of Canada (FCAC) organized Canadians and Their Money: A National Symposium on Financial Capability. The conference stemmed from an initial examination by SEDI...

We still have limited understanding of many issues regarding asset–building policies. What is the role of asset–based approaches in addressing poverty and social exclusion? What does the evidence tell us regarding the advantages and limitations of asset–based policies? What are the...