Discover financial empowerment resources

Discover financial empowerment resources

This year marks the 35th anniversary since the passing of the unanimous all-party federal resolution to end child poverty in Canada by the year 2000. Using tax filer data from 2022, the latest available, this year’s report card found a troubling trend: child poverty increased at record rates two...

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

ABC Life Literacy Canada has unveiled the newest workbook from its HSBC Family Literacy First program, supported by HSBC Bank Canada. The workbook, entitled “Chug-a Chug-a Choo Choose”, includes a story and four new activities that teach children how to compare costs and identify needs and...

Canada’s tax system has a punitive impact on lower income families with children hoping to earn more money, according to a new report from the C.D. Howe Institute. In “Softening the Bite: The Impact of Benefit Clawbacks on Low-Income Families and How to Reduce It,” authors Alex Laurin and...

Families Canada is the national association of Family Support Centres. With a network of 500+ member agencies and thousands of frontline family service workers across Canada, they committed to providing leadership and support in the campaign for Canada’s children. Families Canada has compiled...

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

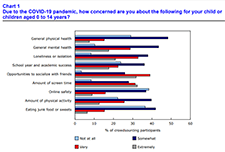

This infographic describes parents' experiences during the COVID-19 pandemic including balancing work and schooling, their children's activities and parents'...

The COVID-19 pandemic has dramatically altered the way of life for Canadian families, parents and children. Because of physical distancing and employment impacts, parents have altered their usual routines and supports, and many children and families have been isolated in their homes for months....

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...

This report from Statistics Canada shares data on median after-tax income and overall poverty rate decline based on 2018...

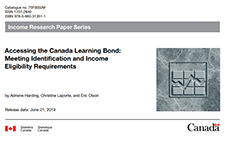

Not having a Social Insurance Number (SIN) and not filing taxes may represent challenges to access government programs and supports such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). Limited data availability has prevented a full assessment of the extent of these...

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay...

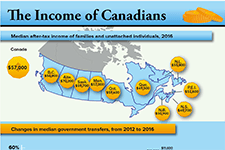

This infographic from Statistics Canada shows the median after-tax income of households, by province, as of 2016. It also shows changes in median government transfers, and number of people living on low incomes according to the after-tax low income...

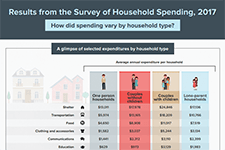

This infographic from Statistics Canada summarizes the results of the Survey of Household Spending, 2017, including average annual expenditures by household...

This article in the Economic Insights series from Statistics Canada examines the economic well-being of millennials by comparing their household balance sheets to those of previous generations of young Canadians. Measured at the same point in their life course, millennials were relatively better...

This Economic Insights article quantifies the degree to which families who expect their financial situation to get better in the next two years have, all else equal, more debt than comparable families. The study shows that even after a large set of socioeconomic characteristics is controlled for,...

Economic well-being has both a present component and a future component. In the present, economic well-being is characterized by the ability of individuals and small groups, such as families or households, to consistently meet their basic needs, including food, clothing, housing, utilities, health...

In this presentation, Nirupa Varatharasan, Research & Evaluation Officer with Prosper Canada, explains the research methods and insights gathered in the report 'Tax time insights: Experiences of people living on low income in Canada.' This includes demographic information, the type of tax...

In this presentation, Uttam Bajwa, Global Health and Research Associate with the Dalla Lana School of Public Health, University of Toronto, reports on tax filing challenges and opportunities for Canadians living on low incomes. This includes the challenges of not knowing what to do, fear and...

The 2018 national report card “Bold Ambitions for Child Poverty Eradication in Canada,” provides a current snapshot of child and family poverty and demonstrates the need for a costed implementation plan to eradicate child poverty in this generation. In advance of the 30th year of the...

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by...

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career...