Discover financial empowerment resources

Discover financial empowerment resources

The Embedded Financial Coaching project builds on evidence that embedding financial coaching into employment services leads to stronger employment and financial well-being outcomes. This report provides insights on the project components including delivering financial coaching services, developing...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

In 2020, the Indigenous Consumer Assistance Network (ICAN) set out to widen the scope of its financial counselling services by looking at how it could deliver a holistic financial counselling framework that could better meet the financial and well-being needs of its service users. Over the past...

Trauma and violence are highly prevalent and have serious impacts on health and well-being. Being aware of how trauma and violence can present during service interactions can improve their effectiveness and client and provider satisfaction and well-being. Financial literacy educators are...

Teachers may incorporate two gamified financial literacy courses that are currently freely available into their lessons. Students can now access two age-appropriate courses designed to help boost students' financial knowledge and confidence at any stage of their financial journey. Course...

How we define financial vulnerability ultimately determines what supports are created and for whom. Is the current definition aimed at helping everyone who needs it? This webinar explores the conception and redefining of financial vulnerability in Canada based on the research and findings from the...

The Consumer Finance Protection Bureau has developed resources to help multilingual communities and newcomers in a selection of languages. The translated financial terms are available in Chinese, Spanish, Vietnamese, Korean and Tagalog. This website has many other multi-lingual resources, covering...

Momentum is a change-making organization that acts as a bridge by taking an economic approach to poverty reduction and adding a social perspective to economic development initiatives. Programs are holistic, covering everything from financial literacy, entrepreneurship and employment training, to...

In 2015, the Consumer Financial Protection Bureau launched the Financial Coaching Initiative, a pilot program that provided financial coaching services to veterans and economically vulnerable consumers. Professional coaches were embedded into 60 host sites across the country, where they provided...

Financial educators are particularly aware of the prevalence of these types of financial arrangements – otherwise known as family financial exchanges (FFEs). To support practitioners helping clients through these often sensitive conversations about these arrangements, the Consumer Financial...

Amidst the COVID-19 lockdown, community service agencies across Canada have had to rapidly adapt the way they engage and support people in the community. A growing number of Canadians need (or soon will need) support as they deal with the financial strain brought on by an unprecedented global...

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their...

These calls, featuring guest practitioners, cover a variety of topics most pressing to the financial coaching field, provide useful tips and resources and serve as a peer-learning platform. Topics include: Financial Coaching Program Design Guide (2/28) - The Role of Financial...

In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through...

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American...

Real Money, Real Experts is a personal finance podcast written and produced by AFCPE (Association for Financial Counseling & Planning Education). Their membership community offers a place for financial counsellors and financial fitness coaches to share best practices, solve similar struggles,...

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: What we know about the health-wealth connection for adults. Why investment in integration is important. How philanthropy can contribute to...

This resource offers a set of common indicators that community organizations can use to measure the reach and impact of their financial empowerment (FE) programming. It is intended for any community organization that works to foster greater financial well-being for economically disadvantaged...

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a...

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE...

The Local Initiative Support Corporation (LISC) developed the strategy Building Sustainable Communities to tackle pressing need through an expansive network of Financial Opportunity Centers (FOCs) in dozens of communities nationwide. FOCs help clients find and maintain good jobs, stick to realistic...

Grantmakers and practitioners recognize the importance of financial security for individuals and families, and many organizations therefore offer financial capability programs aimed at strengthening the financial well-being of the people they serve. But good financial capability programs are often...

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the...

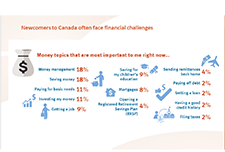

For many newcomers, living in Canada involves learning about finances and money management in new ways. This can include navigating new financial systems, and learning about tax filing and benefits, as well as day-to-day money management and saving. One-on-one financial coaching programs...