Discover financial empowerment resources

Discover financial empowerment resources

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

Bridge to benefits: Implementing benefits access in social service has been created for organizations that are interested in starting, refining or expanding their work in access to benefits services. This includes benefits services such as helping to fill out applications, providing access to...

With a growing number of barriers to accessing vital services, we need to think critically about accessibility and people’s services experiences in the social and public sector. Human-centred design is an approach which centres the voices and lived experiences of people who are impacted in the...

Recover and Rebuild: Helping Canadians build financial security during the pandemic and beyond The 2021 ABLE Financial Empowerment (FE) virtual series is a collection of online financial empowerment events designed to provide frontline FE practitioners, FE...

As practitioners continue to deliver important client-centred services during the COVID-19 pandemic, this can be accompanied by feelings of burnout or compassion fatigue. It can be helpful to establish or renew your practice of self-care, fostering your own physical and mental health during...

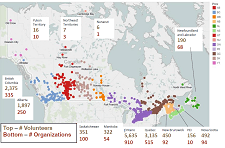

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE...

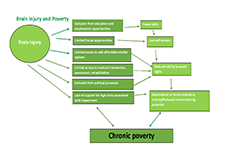

Across Canada, homelessness has always existed but with the creation of statistical reporting across the country the awareness of the pressure this puts on Canadian society is more apparent. The statistics on homelessness are staggering and understanding the path to homelessness, included by those...

Firms and representatives in the financial services industry occasionally encounter situations where a client’s vulnerability causes the client to make decisions that are contrary to his or her financial interests, needs or objectives or that leave him or her exposed to potential financial...

This is a one-hour webinar on the tax filing experiences of Canadians living on low incomes, and some successful strategies frontline practitioners can use to reduce stress at tax time for participants, in their delivery of community tax clinics. The speakers in this webinar are: Nirupa...

This webinar is all about Managing your money, a resource developed to support money conversations and workshops with Indigenous individuals or families. We all strive to achieve a good life or Miyupimaatisiiun. The Managing your money booklet offers a series of seven simple and engaging...

This is a set of tools and resources developed by The Prosperity Agenda to implement a holistic vision of financial coaching for individuals and families. (Note: Accessing the toolkit requires submitting user...

Bright, beautiful, interactive and simple to use, Managing your money offers a series of seven worksheets to help Indigenous individuals and families to set and work towards money goals. Each financial topic and activity features artwork by Simon Brascoupé paired with a teaching from the animal...

This webinar shares insights from three different financial coaching and counselling programs in Canada, discussing what these financial coaching programs look like, program successes, and program challenges. The speakers are: Sheri Fata, Manager of Education and Support Services at Thunder...

For Canadians living with low incomes, tax filing is an important opportunity to boost incomes by accessing a wide range of government benefits. In this webinar, "Insights on hosting volunteer income tax clinics," experts in Canada share their knowledge and practices on what it takes to host...

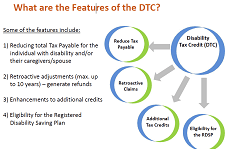

In this webinar, "How to deliver financial supports for people with developmental disabilities," you will learn about financial supports and government programs for people with disabilities in Canada. The topics covered include: social assistance programs, the Disability Tax Credit and other...

Most community-based organizations are accustomed to managing scarce resources, which may discourage them from delivering additional services. However, partnering with other organizations to provide services allows service providers to tap into existing resources and infrastructure instead of...

This brief will provide a variety of insights and recommendations for creating more equitable opportunities and inclusive programs based on the first-hand experiences of organizations across the nation. Learning how organizations recognize the challenges that various communities or populations face...

Immigrants face many of the same challenges that low- and moderate-income communities experience (e.g., low and unstable incomes, poor credit or lack of a credit history, and limited ability to access loans). But they also face a set of unique challenges. For example, immigrants may be hesitant to...

Many service providers work with clients who are financially unstable. Financial instability can vary depending on the person, but common characteristics include having limited or unpredictable income, being behind on rent, not having enough money for food and other basics, and having...

Many service providers work with clients who are financially unstable. Financial instability can vary depending on the person, but common characteristics include having limited or unpredictable income, being behind on rent, not having enough money for food and other basics, and having...

From January 2014 through June 2015, ten community-based organizations from around the United States embarked on an 18-month journey to develop new ways for their low-income clients to progress toward financial security. This document highlights the lessons and successes from that Learning Cluster...

Recognizing the potential of financial coaching to improve the well-being of consumers, the Consumer Financial Protection Bureau (CFPB) commissioned a rigorous study on the impact of financial coaching programs.1 Using a randomized controlled trial design, this study allows, for the first time, a...

This brief discusses the process and results of the Financial Coaching Impact Study to help financial coaches and other financial educators seeking to integrate these techniques into their work. The study showed that coaching is a flexible approach that can work for many types of clients with a...

Every year there is one key and predictable moment – tax time – when many consumers who are struggling to make ends meet have an opportunity to choose to build savings that will insulate them from some of the financial stress that may occur later in the year. In 2013, nearly 93 million...

This information is for front-line workers and advocates working with women who have experienced family violence and who have questions about their immigration status in Canada. Immigration law in Canada is complicated. It is easy to make a serious mistake. It is important that a woman with...