Discover financial empowerment resources

Discover financial empowerment resources

Explore different kinds of insurance and what you can expect to find within insurance...

Financial Services Regulatory Authority, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of non-registered insurable deposits, such as a chequing or savings accounts, up to a maximum amount of $250,000, while deposits in registered accounts, such as RRSPs or TFSAs, have...

Financial Services Regulatory Authority’s role, as a regulator, is to ensure that insurance companies’ proposed rates are fair and not excessive. This website will help you learn about: What to do after an accident How to save on auto insurance Filing a complaint Getting an auto...

Credit unions offer many of the same services as a bank such as cash deposits, investments, mortgages and more. The moment you become a credit union member and make a deposit, your insurable deposits are protected. FSRA, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of...

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money....

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial...

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning...

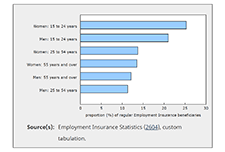

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and...

Fair By Design and Turn2Us (in the United Kingdom) commissioned this research to explore recent changes in the poverty premium landscape, to understand if they are having any impact on the cost of premiums, or the number of people who pay them. Importantly, we did this through the lens of the...

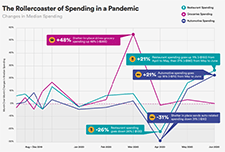

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their...

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill...

The microfinance industry began with the intent to help poor clients help themselves. That’s one reason so many microfinance institutions have embraced the Smart Campaign, which strives to embed a set of client protection principles into the fabric of the microfinance sector. This synthesis...

EPIC’s first issue brief, “Income Volatility: A Primer,” was a comprehensive literature review of what is known about the prevalence, causes, and impacts of income volatility. This second brief looks at managing income volatility at both the household and societal levels. It presents a...

Financial exclusion is a matter of growing concern in Canada considering the decline in the number of mainstream bank branches in some inner-cities and the concurrent rise in the number of fringe banks. This study reports on results from a survey of residents from Winnipeg’s North End, a...

This short statement proposes an agenda for reconstructing much of our social policy over the next decade. Some of these initiatives build on ongoing reforms − most notably those regarding children and parents. The proposals for adults are more radical and far-reaching, calling for deconstruction...

...