Discover financial empowerment resources

Discover financial empowerment resources

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed...

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from...

This article in the Economic Insights series from Statistics Canada examines the economic well-being of millennials by comparing their household balance sheets to those of previous generations of young Canadians. Measured at the same point in their life course, millennials were relatively better...

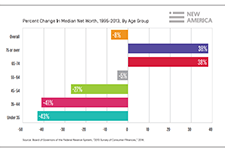

Young adulthood is the life stage when the greatest increases in income and wealth typically occur, yet entering into this period during the Great Recession has put Millennials on a different trajectory. As a result, this generation will need to make very large gains in the years ahead to...

A major national survey conducted in 2016 reveals a bold portrait of Canada’s Millennials (those born between 1980 and 1995), that for the first time presents the social values of this generation, and the distinct segments that help make sense of the different and often contradictory stereotypes...

In this video presentation Andrew Heisz from Statistics Canada explains the changing household assets, debt, and income levels of Canadians of different age generations. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that...

Following the great recession, commentators drew attention to workers with little job security, no benefits and without access to full-time permanent work (Yalnizyan 2012, Van Alphen 2013). This discussion was amplified as millennials voiced their frustrations with poor job prospects amid slow...

In the ongoing national debate over economic opportunity and rising inequality, one important factor is consistently overlooked—the price of housing in elite urban cores. Kotkin’s essay deepens our understanding of inequality and challenges the conventional wisdom about how and where we should...

Millennials (loosely defined here as those born between 1980 and 2000) are often characterized as facing tougher labour market conditions and homeownership barriers, despite being the most highly educated generation in history. However, Canadian millennials are faring better economically than is...

Research shows that many people make poor economic decisions because they are financially illiterate. As we show here, financial ignorance can be expensive and even ruinous, for many. Our goal in this article is to provide an overview of existing work in this important field. We also provide new...

Cornerstone Advisors, in partnership with the Center for Financial Services Innovation (CFSI), produced the following report on strategies for credit unions to attract Gen Y members. The analysis, conducted by Cornerstone Advisors, is based primarily on data from CFSI’s Consumer Financial Health...

In June 2015, Canada launched its first-ever National Strategy for Financial Literacy and the country is now examining how best to increase the financial knowledge and skills of Canadians. On behalf of the Canadian Bankers Association, Abacus conducted an extensive nationwide study of Canadians’...

We are pleased to share the results from the third installment of the Bank of America/USA TODAY Better Money Habits Millennial Report, which measures millennials’ attitudes and priorities around money. The newest findings show that while millennials are reasonably confident about money and are...