Discover financial empowerment resources

Discover financial empowerment resources

The policy brief, Provincial spending on housing and homelessness in Ontario, presents a stark reality: homelessness in Ontario is worsening, with chronic homelessness nearly doubling in just two years. The policy brief finds that: Homelessness is worsening: Over 81,000 Ontarians experienced...

The Canada Disability Benefit is an opportunity to guarantee that people with disabilities can live a life with dignity and have an adequate standard of living. For the new Canada Disability Benefit (CDB) to meet its goal of financially supporting and reducing poverty of people with disabilities,...

In 2019, a comprehensive review (The Countervailing Power: Review of the coordination and funding for financial counselling services across Australia) of financial counselling services in Australia was undertaken and recommendations to ensure the long-term viability of the financial counselling...

An analysis of provincial/territorial health care funding and funding for First Nations and Inuit by Indigenous Services Canada through the First Nations and Inuit Health Branch. This report provides an analytical overview of federal and provincial/territorial government health spending for the...

This report examines Indigenous housing in urban, rural, and northern areas, an expression which is taken to refer to Indigenous housing in all areas of Canada other than on reserves. This report is intended to provide an analysis of unmet Indigenous housing need and homelessness in these areas,...

In an effort to understand the challenges and opportunities facing civil society and community organizations working to improve the quality of Canada’s internet, the Canadian Internet Registration Authority (CIRA) commissioned research firm The Strategic Counsel to conduct a qualitative and...

The federal budget released on April 19, 2021 covers the Canadian government's plan for: Part 1 - Finishing the Fight Against COVID-19 Chapter 1: Keeping Canadians Healthy and Safe Chapter 2: Seeing Canadians and Businesses Through to Recovery Part 2 - Creating Jobs and...

Canada is a prosperous country, yet in 2015 roughly 1 in 8 Canadians lived in poverty. The vision of Opportunity for All – Canada's First Poverty Reduction Strategy is a Canada without poverty, because we all suffer when our fellow citizens are left behind. We are all in this together, from...

This report costs poverty based on three broad measurable components: opportunity costs, remedial costs and intergenerational costs. The authors state that these costs could potentially be reallocated, and benefits could potentially be realized if all poverty were eliminated. The total cost of...

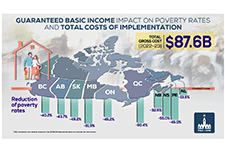

Several parliamentarians requested that the PBO prepare a distributional analysis of Guaranteed Basic Income using parameters set out in Ontario’s basic income pilot project, examine the impact across income quintiles, family types and gender, and identify the net federal revenue increase...

A report from Auditor General Karen Hogan concludes that the Canada Revenue Agency (CRA) managed the Canada Child Benefit (CCB) program so that millions of eligible families received accurate and timely payments. The audit also reviewed the one-time additional payment of up to $300 per child issued...

British Columbia’s Poverty Reduction Strategy, sets a path to reduce overall poverty in B.C. by 25% and child poverty by 50% by 2024. With investments from across Government, TogetherBC reflects government’s commitment to reduce poverty and make life more affordable for British...

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step...

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth...

There were 85 shelters for victims of abuse that had ties to First Nations, Métis or Inuit communities or organizations operating across Canada in 2017/2018. These Indigenous shelters, which are primarily mandated to serve victims of abuse, play an important role for victims leaving abusive...

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to...

The House of Commons Finance Committee recently released its call for pre-budget consultation briefs as the government considers its policy priorities for the 2021 federal budget. This toolkit created by Imagine Canada provides information on the reasons to submit a pre-budget consultation...

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the...

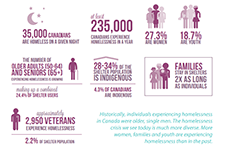

Ending homelessness in Canada requires partnerships across public, private, and not-for-profit sectors. Preventative measures, and providing safe, appropriate, and affordable housing with supports for those experiencing homelessness is needed. This paper provides a series of joint...

First Call BC Child and Youth Advocacy Coalition has been tracking child and family poverty rates in BC for more than two decades. Every November, with the support of the Social Planning and Research Council of BC (SPARC BC), a report card is released with the latest statistics on child and family...

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province,...

The Consumer Financial Protection Bureau (the CFPB) looked at the information sources consumers are exposed to when they make financial decisions. Empowering consumers to make the financial decisions that will help them meet their own life goals is a critical part of the mission of the CFPB. To...

The disability income system is an agglomeration of disparate programs that were designed for distinct purposes. That reality would not actually be a bad thing if at least all the pieces worked well together. A new Basic Income for persons with disabilities would enable the reform of both the...

This report focuses on the role that policy design can have on closing the country’s unrelenting and unacceptable racial wealth divide. We utilize a new framework—The Racial Wealth Audit—launched jointly by the Institute on Assets and Social Policy at Brandeis University (IASP) and Demos to...

The federal government’s decision this year to cancel family income splitting and lower the annual contribution limit for tax-free savings accounts was driven largely by concerns about income inequality. Research by the Canadian Centre for Policy Alternatives, Parliamentary Budget Officer and...