Discover financial empowerment resources

Discover financial empowerment resources

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional...

Since taking office in the fall of 2015, the Liberal government has made important changes to the publicly administered components of Canada’s retirement income system (RIS). It has restored the age of eligibility for benefits under Old Age Security (OAS) and the Guaranteed Income Supplement...

The federal government has indicated that it will expand WITB by approximately $250 million per year beginning in 2019 to “provide additional benefits that roughly offset incremental Canada Pension Plan (CPP) contributions for eligible low-income workers.”1 The changes to CPP will be phased in,...

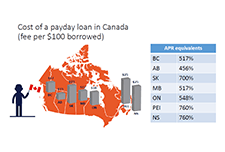

This webinar, "High cost lending in Canada: Risks, regulations, and alternatives," is about why high cost lending products are concerning, especially for financially vulnerable Canadians. Speakers discuss what is driving the use of these products, what kind of regulations are involved, and what...

Aboriginal individuals, entrepreneurs and communities have been affected by financial literacy challenges in many of the same ways that lower-income people and remote populations in Canada have. However, there is the additional weight of specific cultural and structural barriers and the additional...

In 2014, the licensed Canadian payday loan industry provided nearly 4.5 million short-term loans to Canadian households, at a total value of $2.2 billion. Despite its unfavourable reputation, the licensed payday loans industry provides a necessary service for cash-strapped Canadians. Placing...

This is a submission paper by SEDI to the Ontario Ministry of Child and Youth Services. Social and Enterprise Development Innovations (SEDI) is a national charity dedicated to expanding economic opportunity for Canadians living in poverty through program and policy innovation. We are pleased to...

Georgia has long struggled to rein in payday lenders, but even ambitious regulations can’t always stop the predatory practice. This is a brief article written for The New Yorker...

In recent years, there has been growing academic and media attention regarding income inequality—the disparity in the distribution of income across households. This report focuses on a less studied issue, how income varies within households even over relatively short periods of time....

This study seeks to evaluate the environment facing Canadian consumers seeking payday loans online. Specifically, how compliant are the sites consumers are most likely to encounter with relevant provincial legislation? Elements researched include the history and development of legislation, the...