Discover financial empowerment resources

Discover financial empowerment resources

With February 2025 the thirteenth Index Release, the Institute’s Financial Resilience Index Model complements the national Financial Well-Being Studies instrument and the Financial Well-Being Index Model instruments. Access this resource to read the...

The affordable housing crisis in Canada creates many challenges for millions of people trying to find a place to live that they can afford. For many marginalized renters, discrimination presents additional barriers making it even harder for them to find a home. To better understand these...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

FSRA’s role as regulator is to ensure pension plans meet the legal standards in the Pension Benefits Act. They can also help you if you can’t get the information you need from your plan administrator or want to file a complaint about your pension plan. Use this website to learn more...

Fraudsters are master manipulators who leverage relationships to build trust and exploit you financially. Technology makes it easy to become a victim as bad actors can, pretend to be someone you know online, or use artificial intelligence to trick you. According to data from the Canadian Anti-Fraud...

In recent years, social media has become a powerful platform for sharing information. A way to discover new products and lifestyle hacks, everything from gaming to fitness, meal prep, or even finance can be the niche of an online influencer. In today’s digital age, especially post-pandemic, there...

Financial abuse is the most common form of abuse of older adults. As professionals, caregivers, family members and older adults, we all need to understand the impact of financial exploitation and recognize the signs so we can help protect ourselves and those we work with and care for. This...

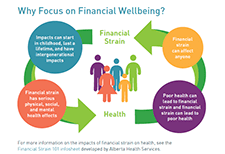

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

In their study, entitled, “Experiences of Financial Stress and Supports in Caregivers During Pediatric Hospital Admission,” Nadarajah et al interviewed caregivers of children admitted to a pediatric hospital and conducted qualitative analyses to assess financial needs, health related financial...

As cash use, access, and acceptance declines in Canada, vulnerable demographics are at risk of being left behind. For many, cash is more than just a method of payment. The growing pattern of electronic payments means that cash could become more scarce, threatening those who rely on it. While a...

Drawing on data for 54,000 households from Statistics Canada's Canadian Income Survey conducted in 2021, a disturbingly high rate of household food insecurity was identified. Food insecurity consists of inadequate or insecure access to food due to financial constraints. The prevalence of...

This study uses the 2022 Portrait of Canadian Society Survey to examine the impact of rising inflation on the lowest income Canadians. Using multiple pre-pandemic data sources, the study takes a closer look at people living in the bottom family income quintile, examining their family income, debt...

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the...

The ballooning cost of living has had a disproportionate impact on low-income households, 77.6% of whom are financially vulnerable or extremely financially vulnerable. Prosper Canada's recently commissioned study from the Financial Resilience Institute, shows the unarguable deteriorating state of...

The Ontario Securities Commission (OSC) published the results of a survey assessing Canadian investors’ financial literacy. As individuals take on more responsibility for their own investing, it is essential that they have enough financial knowledge to effectively participate in Canada’s...

This report is about the financial resilience and financial well-being of Canadians with low incomes based on the Seymour Financial Resilience Index ® It provides a call to action for more targeted support from policymakers, financial institutions and community non profit organizations for...

When it comes to investing, there are many considerations to make before choosing if and what types of investments are best for your situation. This webinar explores the topic of investor education and consumer protection for financially vulnerable Canadians. We'll start by discussing the basics...

How we define financial vulnerability ultimately determines what supports are created and for whom. Is the current definition aimed at helping everyone who needs it? This webinar explores the conception and redefining of financial vulnerability in Canada based on the research and findings from the...

The American Rescue Plan, one of the most significant policy responses to alleviate child poverty in decades, made fundamental changes in enhancing the Child Tax Credit (CTC). In response to the pandemic, the law expanded the CTC for tax year 2021 to ensure a minimum level of economic support to...

Workers earning low to moderate incomes (LMI) continue to face challenges in financial security. The COVID-19 pandemic exacerbated the financial situation of many workers earning LMI. Along with the current macroeconomic environment, it has become even more challenging to build liquid savings for...

Ontario has just become the first province to open its legal gambling market to private internet gaming providers. As of April 4, 2022, Ontarians can play casino-style games online and place bets on sports, including single games, through sites regulated by iGaming Ontario. According to the...

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do...

This report identifies behaviourally informed techniques dealers and advisers can use to encourage their older clients to provide the necessary information for enhanced investor protection...

The health and economic crises brought on by the coronavirus 2019 (COVID-19) pandemic has made the federal nutrition programs more important than ever. An unacceptably high number of people in America do not have enough to eat, and it is likely that the economic recovery for families who struggle...