Discover financial empowerment resources

Discover financial empowerment resources

The tools provided by Autorité des marchés financiers can help guide financial planning for you and your...

No matter where you are in your financial journey—whether you’re beginning your career, saving for your children’s education, planning for retirement, or setting up a legacy for your loved ones—working with a qualified Financial Planner to create a financial plan can significantly help in...

Self-directed investors, or do-it-yourself (DIY) investors, decide which investments they want to buy and sell, and when. They direct their investment strategy themselves. Learn more about DIY investing by accessing this...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

Burnout can happen for many reasons, including being overworked. Dealing with stress can cause problems for your physical and mental health, and your finances. If you’re over-spending or making spontaneous decisions about money to cope with stress, you might be putting your long-term financial...

There are many ways to invest. Your choices will depend on your goals, your timeline and your willingness and ability to accept risk. It’s important to know some basics. This article by CIRO outlines the 5 key principles of investing: can you afford it, diversification, invest for the long term,...

The British Columbia Securities Commission’s InvestRight has unveiled an online space dedicated to women and investing. This comprehensive guide to investing, called Women and Investing, features quizzes and resources explicitly designed to engage more women in investing. To assist you in...

The benefits of spring cleaning can extend beyond your home. Your investment portfolio needs regular maintenance to maximize its performance. A good habit is to regularly review your investment portfolio throughout the year to make sure it aligns with your financial needs. Click on "Access...

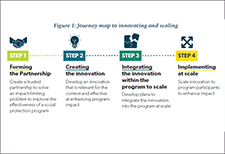

How can we ensure anti-poverty programs are doing the most good for those who need them? One important step is to invest in scaling successful innovations within these programs. With government-led poverty alleviation programs reaching millions of people worldwide, these programs can model how...

Have you ever made an impulsive purchase? Do you struggle to stick to a diet or exercise routine? What’s the longest you have gone in keeping your New Year’s resolutions? The field of behavioural insights tells us that we have an innate desire to live for today at the expense of tomorrow....

Tax-free savings accounts (TFSAs) are designed to help Canadians save more. This comprehensive resource page by the Ontario Securities Commission will help you learn more about TFSAs, what the annual contribution limits are, how to make transfers between TFSAs and the penalties for breaking...

The Ontario Securities Commission (OSC) has launched Investing Academy by GetSmarterAboutMoney.ca as part of Financial Literacy Month. Learn the basics about investing, managing your money, and planning for the future. The courses are available in English or French, and include learning activities,...

This article by Credit Canada helps determine whether it's better to save for the future or pay off existing debts. The "priority pyramid" is a method of visualizing your areas of financial focus from most important to least...

Inflation tells us how much prices have changed year-over-year. It’s noticeable in the cost of everyday things, for example the price of a candy bar today compared to 20 years ago. Over time, increases in inflation tend to be offset by increases in wages, since inflation and wages both tend to...

A collaborative project with provinces to integrate economic, financial and enterprise education into the compulsory school curriculum. See the Building Futures in Manitoba, the Building Futures in Ontario and the new Building Futures in Alberta web sites for more information on these programs and...

Families Canada’s report Financial Empowerment for Women Living on Low Incomes: An Action Plan shares 20 calls to action for adapting financial literacy programming to better support women living on low incomes. To help fulfill some of the calls to action outlined in the report, they’ve just...

Inflation tells us how much prices have changed year-over-year. It’s noticeable in the cost of everyday things, for example the price of a candy bar today compared to 20 years ago. Over time, increases in inflation tend to be offset by increases in wages, since inflation and wages both tend to...

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share...

The average Canadian tax return amount in 2023 is $2,072 and that money can go a long way when it comes to meeting your financial goals. But remember, this isn’t a cash windfall; it’s YOUR money that the government borrowed from you, so Credit Canada recommends using it for needs versus...

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education. Disponible en...

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed. Financial Fitness Self-Assessment Determine how well you are currently managing your finances. Values...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s...

The 2020 Financial Literacy Annual Report details the United States' Bureau of Consumer Financial Protection's financial literacy strategy and activities to improve the financial literacy of consumers. Congress specifically charged the Bureau with conducting financial education programs and...

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American...