Discover financial empowerment resources

Discover financial empowerment resources

Reaching Home: Canada's Homelessness Strategy is a community-based program aimed at preventing and reducing homelessness across Canada. This program provides funding to urban, Indigenous, rural and remote communities to help them address their local homelessness needs. Click "Access this resource"...

Service design consultancy Bridgeable provides an overview of the project partnership with Prosper Canada in April 2020 to take a design sprint approach in providing remote tax-filing and benefits application service solution. Over the course of four consecutive days, Bridgeable worked with...

Global Learning Partners (GLP) helps individuals and organizations to learn by providing practical expertise in learning assessment, design, facilitation and evaluation. Their shareable resources cover a variety of topics in learning, taking a learning-centered approach, including: Learning...

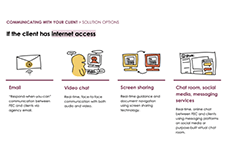

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial...

This paper explores the intersection of digital innovation, digital services, access, and taxpayer rights in the Canadian context, in light of the experiences of vulnerable populations in Canada, from the perspective of the Taxpayers’ Ombudsman. Many aspects of the CRA’s digitalization...

Being homeless, whether briefly or for an extended period of time, can be profoundly distressing for whoever undergoes the experience. This portrait is the result of an exploratory study on homelessness in 13 communities representing five First Nations in Quebec. The report identifies the principal...

Volunteer Income Tax Assistance (VITA) sites are a useful tool for providing free tax preparation services to low-to-moderate income people and helping them claim a range of valuable tax credits, including the Earned Income Tax Credit. In addition, they can help individuals avoid high fees for tax...

Aboriginal individuals, entrepreneurs and communities have been affected by financial literacy challenges in many of the same ways that lower-income people and remote populations in Canada have. However, there is the additional weight of specific cultural and structural barriers and the additional...

This brief overview of the financial literacy needs of Aboriginal peoples was generated through consultations with experts in the field and insights shared by TD Financial Literacy Grant Fund recipients. Its aim is to share knowledge with ABLE Financial Empowerment Conference participants to inform...