Discover financial empowerment resources

Discover financial empowerment resources

The findings in this report highlight the important role of Old Age Security in reducing poverty, with payments under this program making up a large share of annual income for older adults in Toronto’s lowest income deciles. However, too many eligible older adults in Toronto are not receiving OAS...

FSRA’s role as regulator is to ensure pension plans meet the legal standards in the Pension Benefits Act. They can also help you if you can’t get the information you need from your plan administrator or want to file a complaint about your pension plan. Use this website to learn more...

Retirement planning is one of the most important cornerstones of Canadians' financial health. To further our mandate to strive for an effective and sustainable Canadian retirement income system, ACPM is committed to fostering greater financial literacy, and in particular, helping Canadians to...

It's never too early or too late to learn about your retirement options and plan for your future. Using the Government of Canada's newly launched Retirement Hub, find out about public pensions, when to collect them and tips to consider for your retirement income. Get started using their...

A prolonged period of rising inflation and interest rates has led to another significant downturn in the financial wellbeing of adult Canadians, risking their retirement readiness and security, according to the 2023 Canadian Retirement Survey from Healthcare of Ontario Pension Plan (HOOPP) and...

The Ontario Securities Commission (OSC) has shared three tax credits seniors should know about: Age amount Disability amount (for yourself) Pension income amount You may also learn more about sharing tax credits and splitting pension income with your...

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial...

In 2014, a group of non-retired Canadians aged 55 or older was asked about their financial expectations for retirement. New data from 2020 reveal how this same group of Canadians - now retired- is doing...

The key takeaways from the 2022 Canadian Retirement Survey are: Canadians are growing increasingly concerned about day-to-day cost of living impacting their ability to save for retirement. Capacity to save is dissolving for working Canadians, especially for those under 35 Inflation and...

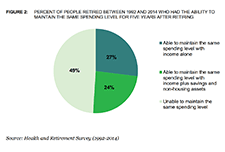

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level...

The ACPM Retirement Literacy Program complements the financial literacy education efforts by the federal and provincial governments, and other organizations. The website contains a series of quizzes to help improve your knowledge of pensions and retirement savings plans as well as links to...

This infographic released by Statistics Canada shows some of the ways the Canadian workforce has changed from 1981 to 2018. Some of these changes include industry, pension coverage, whether jobs are full-time and permanent, and whether they are unionized. These changes have also not been uniform...

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a...

This short video from the Canadian Pension Plan Investment Board explains the new additional Canada Pension Plan...