Discover financial empowerment resources

Discover financial empowerment resources

High levels of household indebtedness in Canada has been a concern for policymakers at all levels of government over the past decade. As the economic costs of COVID-19 grow, household indebtedness becomes a faster growing and increasingly more serious concern. While responsive government...

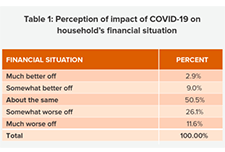

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with...

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from...

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty...

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial...

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or...

This handout is from Module 4 of the Financial Literacy Facilitator Resources. Alternative financial services are outside of the traditional, regulated banking system. They do not take deposits like a bank or credit union. To view full Financial Literacy Facilitator Resources, click...

When household emergencies strike or there’s not enough in the bank to make it to the next paycheck, some families turn to small-dollar credit—small loans from alternative financial service (AFS) providers, such as payday lenders or pawnshops, or from mainstream sources. In October 2014, the...

This report provides an overview of the payday lending landscape in British Columbia compared to the rest of the country and explores the underlying factors contributing to the growth of the industry in recent years. It puts forth a series of recommendations to help ensure consumers have access to...

Financial vulnerability is not limited to the world’s poorest people or nations. Despite the United States’ relative wealth, many Americans are financially insecure, lacking either the ability to meet monthly bills or the necessary savings to cover unexpected expenses. Helping fragile consumers...

Despite the fact that, with only basic identification, all Canadians have the legal right to open a bank account, there has been an explosive growth in fringe financial institutions (FFIs) over the past decade or so which offer financial services such as cheque cashing, payday loans, and income...

This report has two purposes. The first is to document some of the lessons learned from conducting a financial literacy course on behalf of Houselink Community Homes over the winter of 2013/14. We want to share these insights with others who work with consumer survivors and low-income people. The...

Confused about how Canadian households are doing financially? Financial experts, policymakers, and media tell a conflicting story. What is really happening? This presentation is based on data from the Canadian Survey of Financial Capability in 2008 and 2014. It shows the state of Canadian financial...

Financial stability affords families with low incomes a bulwark against the crises of sporadic income, unexpected expenses, and a reliance on predatory fringe services and also provides an opportunity to start actively planning for a solid financial future. Achieving a stable financial foundation...

Alcohol overuse and poverty, each associated with premature death, often exist within disadvantaged neighbourhoods. Cheque cashing places (CCPs) may be opportunistically placed in disadvantaged neighbourhoods, where customers abound. This article explores whether neighbourhood density of CCPs and...

Since the early 1990s payday lending businesses have become increasingly prolific in most parts of Canada, including Calgary. Social agencies and advocates working to reduce poverty view payday lenders and other fringe financial businesses as problematic for those looking to exit the cycle of...

A payday loan (sometimes called a payday advance) is a short-term loan that you promise to pay back from your next paycheque, usually within 14 days. Generally, you are able to borrow between 30 and 50 percent of your take-home pay. Payday loans are very expensive compared to other ways of...

If you’re short on cash, a payday loan may seem like a quick way to get money, but there is a high cost. Fees on payday loans are generally much higher than those on other forms of credit, and they will take a big bite out of your budget. Make sure you have all the facts about a payday loan by...

This paper examines small-dollar credit alternatives to the current payday-loan product in the province of Alberta. While we recognize that most people have credit requirements from time to time, the unbanked and underbanked who can least afford to do so are forced to obtain credit under the...

The Community Sector Council Newfoundland and Labrador (CSC) with support from the TD Financial Literacy Grant Fund, is working in three areas of Newfoundland and Labrador the capacity of community service providers to build the financial literacy skills of low income and economically disadvantaged...

For unbanked and underbanked borrowers, ncome supports, budgeting guidance, and additional savings will not entirely fill the need that credit satisfies. First, well-structured credit can support a household’s ability to save. Second, building a credit history is a critical financial asset in its...

The Center for Financial Services Innovation (CFSI) has conducted an investigation into the amounts that prepaid cardholders spend each month to conduct essential financial transactions, and compared that to the amounts that they would spend if they remained underbanked or used checking accounts...

Payday loans typically carry annual percentage rates of 300 to 500 percent and are due in a lump sum, or balloon payment, on the borrower’s next payday, usually about two weeks later. These loans are advertised as quick fixes for unexpected expenses, but repaying them consumes more than a third...

This report provides a variety of analyses on payday loans, payday installment loans, vehicle title loans, and deposit advance products. There are individual chapters on consumer usage and patters for vehicle title installment loans and payday installment loans, the impact of storefront payday...

Simply doing away with payday loans will help some, but it will also hurt others. To truly improve the small dollar credit market, increased access to well-structured and more affordable small dollar credit (what this paper refers to as enabling small-dollar credit) is vital. Building an enabling...