Discover financial empowerment resources

Discover financial empowerment resources

Canadians with low incomes lack access to the financial help they need to rebuild their financial health and resilience. Watch the webinar from September 17, 2025 as we present findings from our recent report: Closing the Divide: Solutions for Canada’s Financial Help Gap. Prosper Canada’s...

Home ownership may be the biggest investment you’ll ever make, so it’s important to take your time. This resource by the Canadian Bankers Association outlines the types of mortgages, interest rate considerations, mortgage loan insurance, qualifying for a mortgage, renewing a mortgage and...

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

Financial Services Regulatory Authority, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of non-registered insurable deposits, such as a chequing or savings accounts, up to a maximum amount of $250,000, while deposits in registered accounts, such as RRSPs or TFSAs, have...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

This guide, prepared by FAIR Canada, will help consumers who have complaints against their bank or investment firm and want to be financially compensated for their losses. This guide provides and overview of external complaint-handling systems that may be available when seeking compensation. It is...

Credit unions offer many of the same services as a bank such as cash deposits, investments, mortgages and more. The moment you become a credit union member and make a deposit, your insurable deposits are protected. FSRA, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of...

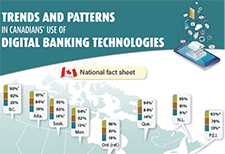

FCAC and Statistics Canada collaborated on fact sheets examining trends in digital banking at the national, provincial and territorial level. This work aims to further financial inclusion by helping identify which groups are most likely to face barriers. It also supports the National Financial...

FCAC’s new webpage, Choosing a financial institution, will help consumers determine which type of financial institution best meets their needs. The topics covered include: Identifying the financial products and services you need Deciding if you want all your products and services with one...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

Fast facts: More than 99 per cent of Canadians have a bank account 31 per cent of Canadians say they pay no service fees at all and another 45 per cent pay $15 or less per month Canadians are careful borrowers. Only 0.17 per cent of mortgages are in arrears Access this resource to read...

In Canada, laws and regulations protect financial consumers, ensuring they are treated fairly and have access to essential banking services. These rules prioritize helping people achieve better financial outcomes, especially concerning homeownership and mortgage difficulties. The Canada Mortgage...

At first glance, the latest FDIC National Survey of Unbanked and Underbanked Households findings are encouraging: rates of un- and underbanked households reached historic lows after trending downward for the last decade. Yet, a lack of access to quality banking remains a problem for nearly 25...

The banking industry has long recognized that it has a role to play strengthening the financial literacy skills of all Canadians. That’s why the CBA administers Your Money Seniors, a free, non-commercial seminar program developed in collaboration with the Financial Consumer Agency of Canada...

World Elder Abuse Awareness Day takes place each year on June 15th and is a good opportunity to remind ourselves, friends and family about the importance of recognizing the signs of financial abuse and taking preventative measures. Older adults are often the target of financial abuse, but anyone...

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money....

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning...

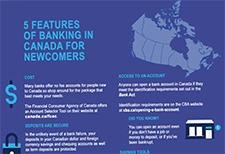

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the...

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world....

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional...

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the...

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the...

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Pricing is clear, transparent, and well understood Pricing is representative of the cost of funds, cost of administration and risk, rather than what the market will...

This report explores the financial services complaint experiences of Canadians at various income levels who used the Ombudsman for Banking Services and Investments (OBSI)’s service. The national, not-for-profit organization collected demographic and case data for almost 1,000 closed cases...