Discover financial empowerment resources

Discover financial empowerment resources

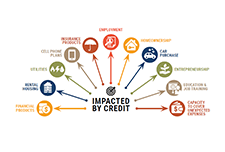

This report explores the barriers newcomers face in accessing credit, and opportunities for governments, financial institutions, settlement agencies, fintech, investors and funders, and community organizations to better respond to this growing segment of the...

Home ownership may be the biggest investment you’ll ever make, so it’s important to take your time. This resource by the Canadian Bankers Association outlines the types of mortgages, interest rate considerations, mortgage loan insurance, qualifying for a mortgage, renewing a mortgage and...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

Credit unions offer many of the same services as a bank such as cash deposits, investments, mortgages and more. The moment you become a credit union member and make a deposit, your insurable deposits are protected. FSRA, through the Deposit Insurance Reserve Fund (DIRF), provides coverage of...

The Behavioural Insights Team, in conjunction with Fair4All Finance, have worked with three community finance providers to launch a new customer engagement support guide to better improve customer engagement using insights from behavioural science. Building on our work with three lenders, this...

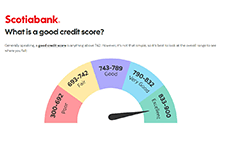

Looking to give your credit score a lift? Credit Canada can show you how to obtain your credit score, what it means, and how to get it into better shape. Click on "Access this resource" to learn...

This free new course for newcomers consists of 4 short modules that should take 10-15 minutes each to complete. Each module includes short case studies, mini quizzes and other interactive elements. The topics for each module are: Essentials of credit in Canada How to build your credit...

A collaborative project with provinces to integrate economic, financial and enterprise education into the compulsory school curriculum. See the Building Futures in Manitoba, the Building Futures in Ontario and the new Building Futures in Alberta web sites for more information on these programs and...

This presentation at the Canadian Economics Association by Professor Annamaria Lusardi, looks at how we measure financial literacy, how we measure the impact of financial literacy on behaviour, how this data and these findings may be used to design policy and programs and what the implications for...

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money....

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...),...

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

Managing your finances means finding the right balance. Inflation and higher interest rates signal that you may need to adjust your budget to find the right balance between daily spending and paying down debt. The right balance will depend on your financial situation and goals. This selection of...

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other...

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have...

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey...

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that...

The Thriving or Surviving study uncovers the kitchen table issues that confront Canadians daily, revealing how the country is coping with concerns such as debt, savings, emergency funds and financial...

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and...

Money Mentors’ free online courses are available to everyone. The 1-2 hour narrated courses make it easy to learn at your own pace. These online courses provide the same great content as our in-person presentations, but at the touch of a finger. They cover a variety of topics including...

ACORN Canada undertook a study focusing on high interest loans, especially when taken online. For the purpose of the study, high interest loans were defined as loans such as payday loans, installment loans, title loans etc. that are taken from companies/institutions that are not regular banks or...