Discover financial empowerment resources

Discover financial empowerment resources

Looking to give your credit score a lift? Credit Canada can show you how to obtain your credit score, what it means, and how to get it into better shape. Click on "Access this resource" to learn...

When Canadians have a financial problem, want to make a financial plan, or need help with their taxes, most simply reach out to their financial institution, adviser, accountant, or commercial tax preparer for the help they need. But who do low-income individuals turn to? A new report by Prosper...

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling...

This report used a longitudinal, nationally-representative sample of approximately five million de-identified credit records maintained by one of the three nationwide consumer reporting agencies. Trends in debt settlement and credit counseling during the Great Recession and in recent years are...

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and...

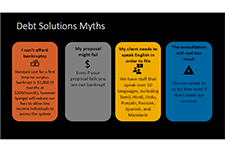

This is a one-hour webinar on debt management solutions in Canada for situations where someone's debt is significant enough that specialized solutions are needed. The speakers explain what steps are likely to be involved in the credit counselling process in setting up a debt management plan, or...

This study addresses these gaps in the literature through an evaluation of a nationwide credit counselling program called Sharpen Your Financial Focus, an initiative launched by the National Foundation for Credit Counseling (NFCC) in September of 2013. The Sharpen initiative builds upon and...

This short guide explains the process of getting debt management help from a credit counselling agency. Credit counselling agencies provide a range of services for people in financial difficulty. One of the most common services they offer is help with finding the best strategy to pay off your debt...

This Guide seeks to define characteristics of a high- quality small-dollar credit product. It does not assume, however, that credit is the answer for every consumer. When people who face a chronic income shortfall or who already have debts they cannot manage use credit to meet their basic needs,...