Discover financial empowerment resources

Discover financial empowerment resources

Financial freedom is possible. Start by understanding your financial situation. Use these free resources to help you manage your money, get out of debt and plan for...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

Money and Youth starts with an exploration of one’s values and covers how to make good decisions – and be aware of those who will try to influence decisions and how they can go about doing so. The book then proceeds through a learning framework looking at the challenges and opportunities of...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

The Dollars Seen Differently podcast breaks down financial topics to make them more accessible for people who are blind, Deafblind or have low vision. Hosted by Ryan Hooey, each episode features a down-to-earth conversation with financial experts, offering practical tips and resources on topics...

Burnout can happen for many reasons, including being overworked. Dealing with stress can cause problems for your physical and mental health, and your finances. If you’re over-spending or making spontaneous decisions about money to cope with stress, you might be putting your long-term financial...

Struggling to pay your mortgage? FCAC expects federally regulated financial institutions to help you if you're struggling to pay your mortgage due to exceptional circumstances. Learn more about paying your mortgage when experiencing financial...

In the scope of personal finance, individuals often struggle with the decision of whether to pay down debt they’ve accumulated or allocate funds towards investments that will grow for the future. Either choice can make sense, depending on the situation and each individual’s stage of life. In...

This handbook from Money Mentors Alberta outlines the steps to rebuild your...

One of the goals of The Money and Pensions Service (MaPS) is to provide better debt advice. While debt advice is available in many different forms, many people who could benefit from debt advice do not seek help. In this study, we sought to better understand the barriers and drivers to people...

Debt can be a useful financial tool. Loans can help you buy a car or a home. And if you use credit cards, you can sometimes collect other benefits like travel miles or points you can spend. However, too much debt can make it difficult to save money and limit your financial options now and in the...

In time for Financial Literacy Month, the Financial Consumer Agency of Canada has released several resources on their website. Checking up on your progress in managing and paying down debt is an important part of maintaining your overall financial health. This infographic outlines how to...

Widespread household financial insecurity is an undeniably urgent crisis in the United States today. A stunning 51 percent of U.S. households have expenses that are equal to or greater than their income, and 55 percent lack the necessary savings to weather a simultaneous income drop and expense...

The weekly themes for Financial Literacy Month 2023 are: Week 1 (November 1-4): Get the pulse on your financial health – What is financial health and why is it important? Week 2 (November 5-11): Check up on your debt – Check up on your progress in managing and paying down debt. Week 3...

The FCAC has updated their dashboard that present the result of two FCAC surveys: the COVID-19 Financial Well-being Survey and the Survey on Canadians' use of Bank Products and Services. The dashboard was updated in July 2023 with data collected between August 2020 and May 2023. Some indicators...

A collaborative project with provinces to integrate economic, financial and enterprise education into the compulsory school curriculum. See the Building Futures in Manitoba, the Building Futures in Ontario and the new Building Futures in Alberta web sites for more information on these programs and...

Between the high cost of living and inflation, many of us are struggling with debt. But with financial advice available everywhere - from your uncle’s friend to social media influencers, it can be easy to feel overwhelmed and hard to know whose advice you can trust. Learning some key warning...

Did you know Canadians have the highest level of household debt in the G7? While debt can be useful it can also be stressful. Consider trying some solid strategies to help you tackle your debt and get on firmer financial...

There are many options to deal with debt, but if it sounds too good to be true—it probably is. Ask questions and shop around to avoid paying unnecessary fees. The Office of the Superintendent of Bankruptcy Canada has put together a host of useful tools around debt based on an individual's...

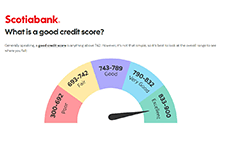

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...),...

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help...

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

This study uses the 2022 Portrait of Canadian Society Survey to examine the impact of rising inflation on the lowest income Canadians. Using multiple pre-pandemic data sources, the study takes a closer look at people living in the bottom family income quintile, examining their family income, debt...

Managing your finances means finding the right balance. Inflation and higher interest rates signal that you may need to adjust your budget to find the right balance between daily spending and paying down debt. The right balance will depend on your financial situation and goals. This selection of...