Discover financial empowerment resources

Discover financial empowerment resources

Many Canadians assume that poverty among seniors is a minor issue. That the income security system provides enough for the elderly to live with dignity. But this new report reveals a different reality: 430,000 seniors in Canada live below the Official Poverty Line. Why does seniors’ poverty...

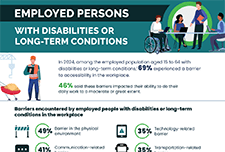

This infographic highlights key findings on accessibility barriers among employed persons aged 15 to 64 with disabilities or long-term conditions. The population covered by the Survey Series on Accessibility - Experiences with Accessibility and Employment (SSA-EAE) comprised those who participated...

The Dollars Seen Differently podcast breaks down financial topics to make them more accessible for people who are blind, Deafblind or have low vision. Hosted by Ryan Hooey, each episode features a down-to-earth conversation with financial experts, offering practical tips and resources on topics...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

Every day in Canada, nearly 1 in 4 people worry about eating, compromise on the quantity and quality of their groceries and/or go without food due to financial constraints. Food insecurity disproportionately impacts some groups, including Indigenous and racialized peoples, people with...

Interpreting the data: Key takeaways from Welfare in Canada, 2023. For nearly 40 years, the annual Welfare in Canada series and its predecessors have documented the depth of poverty that persists for people receiving social assistance. The 2023 edition builds on this work to provide a...

The Welfare in Canada reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and...

Maytree has compiled an advocacy toolkit to help you advocate for the Canada Disability Benefit (CDB). This toolkit consists of an introduction, additional resources and frequently asked questions and the toolkit. You may download the toolkit by jurisdiction on their website: Advocacy...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

AFN's 2023 Annual Report gives a high level review of their work last year. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects our work over the...

Parents and caregivers worry about who will be there when they are no longer able to care for their loved ones with a disability. It is a question that weighs heavy on families. Family members, or parents, want to know what options will be available and who will be making decisions for their loved...

Upwards of 450,000 Indigenous people identify as having a disability, functional, or activity limitation, but it is unknown how many of those people are women, girls, or gender diverse because of inaccurate and insufficient data. Indigenous people are more susceptible to living with a disability...

The Canada Disability Benefit is an opportunity to guarantee that people with disabilities can live a life with dignity and have an adequate standard of living. For the new Canada Disability Benefit (CDB) to meet its goal of financially supporting and reducing poverty of people with disabilities,...

This publication is an outreach product to help promote the program "How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability". This infographic was created in response to feedback from stakeholders and was designed in collaboration with experts in...

The report presents a summary of CDSP annual statistics up to the end of 2022. These include the RDSP take-up rates, the number of RDSP beneficiaries, and the values of CDSB, CDSG, contributions, and total assets. Starting in 2024, the program will release comprehensive CDSP statistics on an annual...

This report provides insights from the project, including highlighting the challenges people with disabilities in British Columbia face in their journey to get income benefits, the opportunities to remove those barriers and implications for future benefits design. The demand for access to benefits...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

The Welfare in Canada reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and...

For some individuals with a disability, the main labour market challenge is to find employment. Others may find it difficult to retain their jobs or qualify for promotion opportunities. This study offers important new insights into the life-long evolution of the earnings of individuals whose...

Employment and income experiences for persons with disabilities often differ from persons without disabilities. Barriers to accessibility within these areas often lead to lower employment rates and decreased income levels for persons with disabilities, in relation to persons without...

The Ontario Securities Commission (OSC) has shared three tax credits seniors should know about: Age amount Disability amount (for yourself) Pension income amount You may also learn more about sharing tax credits and splitting pension income with your...

This infographic by community food centres Canada provides a helpful visual summary of tax benefits that can add to income or reduce the taxes Canadians pay when they file their tax return. The information is especially useful for people: Working or living on a low income; Living with a...

In 2014, a group of non-retired Canadians aged 55 or older was asked about their financial expectations for retirement. New data from 2020 reveal how this same group of Canadians - now retired- is doing...

The CRA has compiled benefits and credits factsheets for: Students Persons with disabilities Modest income individuals Housing insecure individuals Adults 65 and older Women in shelters Indigenous peoples Newcomers These are available in English and...

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility...