Discover financial empowerment resources

Discover financial empowerment resources

This policy brief argues that employment is not a viable path out of poverty unless policy interventions first address the barriers that prevent work and create a labour market that offers decent jobs. A successful poverty reduction strategy must also speak to the needs of those who will never work...

Gig workers account for approximately 25 to 35% of the national workforce. When considering workers earning low to moderate incomes (LMI), these percentages are likely higher. Gig work provides reported advantages including flexibility, supplemental income, and independence. However, it also brings...

Since visible minorities often have more precarious employment and higher poverty rates than the White population, their ability to adjust to income losses due to work interruptions is likely more limited. Based on a large crowdsourcing data collection initiative, this study examines the economic...

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique...

The economic lockdown to stop the spread of COVID-19 has led to steep declines in employment and hours worked for many Canadians. For workers in essential services, in jobs that can be done with proper physical distancing measures or in jobs that can be done from home, the likelihood of...

Findings from a web panel survey developed by Statistics Canada on how Canadians are coping with COVID-19. More than 4,600 people in the 10 provinces responded to this survey from March 29 to April 3. In addition to content on the concerns of Canadians and the precautions they took to reduce...

This brief emerged from a conversation, held in late March 2020, among a number of individuals and organizations who work on issues of household financial security. Employers with financial resources and governments have an opportunity to use the workplace as a significant channel to deliver...

This report explores the implications of new technologies on Canada’s economy and labour market and the adequacy of current social programs and policies supporting...

In this video presentation Sunil Johal from the Mowat Centre explains how social policy in the 21st century could be redesigned to accommodate the changing nature of work and income in Canada. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read...

In this video presentation David Mitchell from the Aspen Institute explains strategies for mitigating and preventing income volatility at the household level. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies...

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) shares some of the findings from the U.S. Financial Diaries project. He explains how the households in the study experience multiple "spikes" and "dips" in income and spending over the course of a single...

In this video presentation Fiona Greig from the JP Morgan Chase Institute explains what banking data can tell us about income volatility in the United States. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies...

The Gig Worker On-Demand Economy survey was conducted online by Harris Poll on behalf of Prudential from January 5 to February 18, 2017, among a nationally representative (U.S.) sample of 1,491 workers including 514 full-time and 256 part-time traditional employees and 721 gig workers. Gig work was...

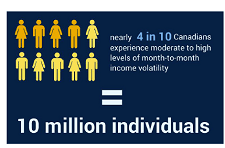

A growing number of Canadians are living with fluctuating incomes - incomes which may vary significantly from month to month, not just from year to year. This makes it difficult to save, plan, and achieve financial wellness. This webinar, "Income volatility in Canada: Why it matters and what to do...

This is a pre-budget presentation from the Government of Canada on the state of the middle class in Canada. Middle class challenges, successes, and government commitments. All Canadians benefit from strong, sustained, and inclusive economic growth and everyone has a real and fair chance at economic...

Most employment research focuses on the quantity of work, such as whether or not people are employed, the number of hours they work, and barriers to work. Which hours of the day employees must work has received less attention. This paper examines nonstandard work schedules within the confines of...

Even before the sharp and enduring increase in unemployment brought on by the Great Recession, policymakers and researchers were concerned about the “hollowing out” of the U.S. labor market. Over the last 25 years, employment and earnings growth for workers in middle-skill jobs has lagged...

We define precarious employment as having an outsized level of uncertainty, whether in terms of pay, ongoing employment, scheduling, or other dimensions. Types of work associated with precarious employment are typically lower paying, with an income gap of between $11,600 and $18,000 in 2014...

While the recession may technically draw to a close in the third quarter, its reverberations will be felt for some time. Most notably, recovery will be sluggish relative to that in the wake of past recessions. Unemployment will continue to rise into 2010 as re-hiring proceeds slowly and more...

The Education Policy Research Initiative (EPRI), a national research organization based at the University of Ottawa, has used administrative student data held by 14 post-secondary education (PSE) institutions in four different regions of the country linked to tax files at Statistics Canada in order...

Following the great recession, commentators drew attention to workers with little job security, no benefits and without access to full-time permanent work (Yalnizyan 2012, Van Alphen 2013). This discussion was amplified as millennials voiced their frustrations with poor job prospects amid slow...

In its 2016 budget, the Government of Ontario committed to conducting a basic income pilot project as part of its preparations for comprehensive reform of its social assistance programs. Taking particular note of “today’s dynamic labour market” and a need to “strengthen the attachment to...

This is a report on child poverty in British Columbia and connections to the working poor, employment insecurity, living on low incomes, and gives policy recommendations to respond to this...

There was a time, not very long ago, when Canadians were savers. In 1982, we routinely set aside 20 percent of our yearly income for large household purchases, education, starting businesses, retirement or just plain rainy days. Having a savings ‘nest egg’ was accepted wisdom and the norm. Then...

Americans experience tremendous income volatility, and that volatility is on the rise. Income volatility matters because it is hard to manage. The typical household faces a shortfall in the financial buffer necessary to weather this volatility. Moreover, the decline in real wages since 2009 for all...