Discover financial empowerment resources

Discover financial empowerment resources

A government designs a great service or program to support its residents. Although many people qualify, the program receives just a few applications. How can we increase uptake? This is a common question the Behavioral Insights Team (BIT) has helped governments answer across many policy...

CIRO works within the Canadian regulatory framework to help contribute to investor confidence and security. In collaboration with these other organizations, CIRO is committed to the protection of investors and maintaining the integrity of the Canadian capital markets. We want to build Canadians’...

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional...

Improving people’s financial circumstances has never been more critical. Disadvantaged population groups have experienced even higher levels of financial strain and poor financial wellbeing during the pandemic. This has negatively impacted their physical and mental health. To support efforts to...

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the...

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to...

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults,...

Prosper Canada and AFOA Canada are pleased to collaboratively tell the story of The Shared Path: First Nations Financial Wellness. This work was undertaken in the spirit of reconciliation between Indigenous Peoples and non-Indigenous people in Canada and creating a more equitable and inclusive...

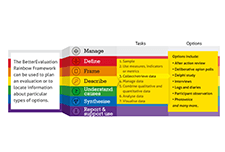

The Rainbow Framework organizes different methods and processes that can be used in monitoring and evaluation. The range of tasks are organised into seven colour-coded clusters: Manage, Define, Frame, Describe, Understand Causes, Synthesise, and Report & Support Use. Users can use the...

This webinar, "Indigenous financial wellness in Canada," introduces an Indigenous financial wellness framework, identifies some of the key barriers and opportunities for building financial wellness in Indigenous communities, and highlights evidence-based best practices for building financial...

Most community-based organizations are accustomed to managing scarce resources, which may discourage them from delivering additional services. However, partnering with other organizations to provide services allows service providers to tap into existing resources and infrastructure instead of...

This is a presentation by Jerry Buckland at the AFOA Canada Conference in February 2017. It covers: 1.An Indigenous Financial Wellness Framework: demonstrates the need to boost capability and inclusion; 2.Results from a Manitoba case study of financial exclusion; 3.Lessons from abroad: the...

This overview paper broadly outlines the types of strategies being used to help people move up from poverty. It lays out basic categories for classifying such programs, explains the logic of various approaches, and offers some broad pros and cons of various types of interventions. The accompanying...

This is a Presentation showing several different frameworks for assets and financial capability, collected by the CFED. This includes the Household Financial Security framework, the Financial Capability Lifecycle, Road to Economic Security, and...

This report is the second of two complementary reports that address the issue of economic security for Indiana households. The Self-Sufficiency Standard approach to economic security consists of three elements: securing the costs of daily basic needs, creating an emergency savings fund, and...

This is an infographic on the Adaptive Prosperity framework developed by the Indiana Association for Community Economic Development. This is a collaborative vision of empowerment and assets focused on all parts of a...

More than ever, Americans need to be financially savvy. The past few years have shown that mortgages can be complicated, business-cycle downswings severe, and investing far from obvious. And, for many of us, saving is not easy. Creating a successful financial life takes a high level of know-how and...

This is a presentation by J. Michael Collins explaining why financial coaching is a more effective intervention to achieve financial capability, compared to financial literacy. He explains the role of counseling, a definition of financial coaching, the role of the coach, and coaching as a form of...

There is much evidence that the quality of the social determinants of health Canadians experience helps explain the wide health inequalities that exist among Canadians. How long Canadians can expect to live and whether they will experience cardiovascular disease or adult-onset diabetes is very much...

The report discussed in this brief, “Building blocks to help youth achieve financial capability: A new model and recommendations,” illuminates critical attributes, abilities, and opportunities acquired during the years spanning preschool through young adulthood that support the development...

Where and when during childhood and adolescence do people acquire the foundations of financial capability? The Consumer Financial Protection Bureau (CFPB) researched the childhood origins of financial capability and well-being to identify those roots and to find promising practices and...

Understanding financial well-being is crucial to helping consumers achieve it. Financial educators, coaches, and other practitioners work to help people improve their financial lives and get to a better state of financial well-being. To tell whether these efforts are successful, the field needs a...

This report explores New Zealand’s ‘Bright Spots’ – local places and community initiatives that are making a positive difference to children and families. Instead of asking about the issues and problems for ‘vulnerable children’ or ‘high-needs families’, we ask ‘what’s...

This article is about evolving frameworks for collective impact. CI is now a permanent – even dominant – part of the landscape of community change. We believe that it’s time for an evolution in the revolution. First, there has been enough experimentation with CI, by diverse communities...

As Congress debates a long-term path to American economic growth, American households confront their own daunting challenges to economic security and success. While tight budgets, polarized politics and a skeptical public constrain policymakers’ ambitions, Americans have yet to recover from the...