Discover financial empowerment resources

Discover financial empowerment resources

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

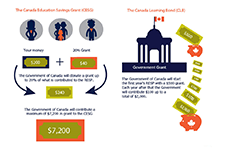

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools,...

Estimate your child(ren)'s future education costs, and see how your planned RESP savings, including contributions and grants, will cover those...

Education after high school, or postsecondary education (PSE), is an important determinant of individuals’ future opportunities, as well as their health and even lifespan. Children’s Savings Accounts (CSAs) are programs that aim to increase access to PSE by building parents’ and children’s...

Intuit is committed to helping students across the country work towards a more prosperous financial future by equipping them with the education they need to feel confident about their taxes. Through the Intuit TurboTax Simulation, we are helping students overcome the fear of Tax Day. You do not...

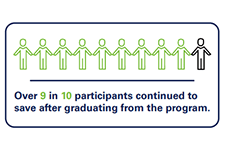

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

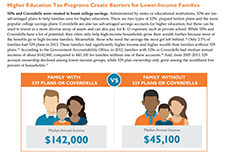

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a...

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and...

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships...

Persons with a disability face a higher risk of low income compared to the overall population. This report uses data from the 2014 Longitudinal and International Study of Adults (LISA) to study the relationship between low income and characteristics of people aged 25 to 64 with a disability,...

This report examines the relationship between the earnings of Canadians in the labour market and their post-secondary education credentials. Findings are based upon information gathered from the 2016 Census on adults between the ages of 25 to 64 with different levels of education and working in...

In this brief, we articulate why collaboration between community foundations and CSA programs is in their mutual interest. We describe the variety of roles that community foundations can play in promoting the growth and success of CSA programs, and then identify the primary challenges encountered...

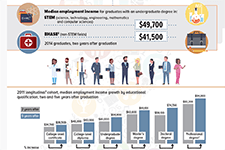

This infographic from Statistics Canada shows the labour market outcomes for college and university graduates between 2010 and 2014. It shows the median employment income achieved by graduates of different education levels, 2 years and 5 years post-graduation. Overall, it shows that people with...

As student loan reform continues to dominate national discourse, a NEFE-funded study shows that financial education in states with state-mandated personal finance graduation requirements causes students to make better decisions about how to pay for college. It increases applications for aid,...

This is a one-hour webinar on increasing take up of Registered Education Savings Plans (RESPs) among people on low incomes. Our panelists share challenges and success stories in their work to help clients save for their children’s post-secondary education. Learn successful outreach strategies,...

Canada’s performance in higher education and skills development has been fairly strong for many years. On key measures we are at or near the top of international rankings and our highly skilled people contribute to economic competitiveness, social innovation, and political and community...

This Economic Insights article documents the characteristics of families with children under the age of 18 who hold registered education savings plan (RESP) investments. The article also examines the relationship between holding an RESP account at age 15 and postsecondary enrolment between the ages...

We characterize rates of intergenerational income mobility at each college in the United States using administrative data for over 30 million college students from 1999-2013. First, access to colleges varies greatly by parent income. Second, children from low and high-income families have very...

We use data for a large sample of Ontario students who are observed over five years from their initial entry into high school to study differences in postsecondary education participation. The students are grouped by average neighbourhood income and birthplace (Canadian or foreign‐born). We find...

This is the first in a series of @ Issue Papers that looks at the participation of traditionally under-represented cohorts in postsecondary education. The purpose of this @ Issue Paper is to summarize what is currently known about the participation of low-income students in PSE, with a particular...

This article examines the literacy and numeracy skills of off-reserve First Nations and Métis adults, focusing on the factors and labour market outcomes associated with higher skill levels. In this study, individuals in the higher range for literacy and numeracy are defined as those who scored...

The Omega Foundation commissioned this research to better assess the influence of education savings and the federal government’s savings incentive grants for saving on post-secondary access. Our hope was to clarify the facts which have until now been largely obscured. This information gap has...

While the recession may technically draw to a close in the third quarter, its reverberations will be felt for some time. Most notably, recovery will be sluggish relative to that in the wake of past recessions. Unemployment will continue to rise into 2010 as re-hiring proceeds slowly and more...