Discover financial empowerment resources

Discover financial empowerment resources

Safe and Secure is an online book that helps you imagine, plan, and take action toward building a good and purposeful life, and a secure future, for your family member with a disability. First published in 1996, Safe and Secure was created to help families imagine and plan...

Investments generate different types of revenues, such as: Interest; Capital gains; Dividends. Certain types of investment revenues are more taxable than others. Several plans offer tax benefits that you can take advantage of. Thus, when you invest in these plans, the type of...

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

The Dollars Seen Differently podcast breaks down financial topics to make them more accessible for people who are blind, Deafblind or have low vision. Hosted by Ryan Hooey, each episode features a down-to-earth conversation with financial experts, offering practical tips and resources on topics...

There are many ways to invest. Your choices will depend on your goals, your timeline and your willingness and ability to accept risk. It’s important to know some basics. Investing puts your money to work to achieve your financial goals. One way is to earn interest on a sum of money you invest....

Parents and caregivers worry about who will be there when they are no longer able to care for their loved ones with a disability. It is a question that weighs heavy on families. Family members, or parents, want to know what options will be available and who will be making decisions for their loved...

This publication is an outreach product to help promote the program "How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability". This infographic was created in response to feedback from stakeholders and was designed in collaboration with experts in...

The report presents a summary of CDSP annual statistics up to the end of 2022. These include the RDSP take-up rates, the number of RDSP beneficiaries, and the values of CDSB, CDSG, contributions, and total assets. Starting in 2024, the program will release comprehensive CDSP statistics on an annual...

There are rules about how much money a person living on Ontario Works can receive in gifts or “voluntary payments”. Generally, a person living on Ontario Works can receive gifts up to a maximum of $10,000 in a 12-month period. There are rules around reporting gifts, and decisions on how to...

People save for different reasons. For instance, you may want to save for emergencies, or for your children’s education, or for your old age. Having goals for your savings helps to keep you motivated. You sleep better knowing you have some money set aside. Saving accounts earn interest. That...

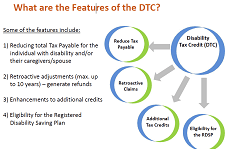

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP. Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability...

Whether you’re new to investing, or new to Canada, InvestingIntroduction.ca can help. Visit the Ontario Securities Commission's refreshed website and find resources to help you make more informed investment decisions and better protect your money. The information is available in 22...

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the...

The P4P Planning Network was launched by Partners for Planning to support relatives, friends, or caregivers of a person with a disability with planning resources and tools. Resources on relationship building, school transitions, community involvement, financial objectives and more are shared and...

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered...

The Plan Institute Learning Centre presents workshops, webinars, publications and other resources for individuals and/or families of a person with a disability, support-care workers, and...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

Enhance the quality of life for a family member with a disability. By answering a few simple questions, the RDSP Calculator can help you project the estimated future value of an RDSP, and the approximate value of future withdrawal payments. Run various scenarios to see how it would affect the value...

The Disability Tax Credit helps Canadians by reducing the amount of income tax they are required to pay. The Registered Disability Savings Plan helps people with a disability or their caregiver save for the future by putting money into a fund that grows tax free until the beneficiary makes a...

Delivered in partnership with Plan Institute, this webinar "Future planning tips for people with disabilities and those who support them," discusses how planning for A Good Life can lead to achieving greater peace of mind about the present. This webinar also introduces the online Future Planning...

In this webinar, "How to deliver financial supports for people with developmental disabilities," you will learn about financial supports and government programs for people with disabilities in Canada. The topics covered include: social assistance programs, the Disability Tax Credit and other...

Registered disability savings plans (RDSPs) were announced in the 2007 federal budget in response to recommendations by the Expert Panel on Financial Security for Children with Severe Disabilities. The objective of the RDSP program is to enable parents and others to save for the medium- and...

This is a brief guide on the Registered Disability Savings Plan, what it is, how to apply, and what you need to set it...

This guide is for two groups of people: 1. Individuals with disabilities who are opening an RDSP for themselves, and; 2. Families or friends who are opening an RDSP for their son/daughter/friend with a disability. The main part of the guide speaks to individuals and the boxes are specific to...

This presentation explains the Registered Disability Savings Program available in Canada. It is a vehicle to save and invest funds for the future, with matched funding from the...