Discover financial empowerment resources

Discover financial empowerment resources

Many Canadians assume that poverty among seniors is a minor issue. That the income security system provides enough for the elderly to live with dignity. But this new report reveals a different reality: 430,000 seniors in Canada live below the Official Poverty Line. Why does seniors’ poverty...

Home improvement projects can be a great way to update and enhance your living space. For some older adults in Canada, however, these projects can sometimes lead to scams and financial abuse. While anyone can be a victim of financial fraud, older adults are often a target for door-to-door...

Wellesley Institute’s Thriving in the City1 framework is a valuable tool for understanding what resources an individual needs to live a healthy life and assessing how the current policy environment meets these needs. While the previous report focused on working-age adults (25-40 years old),2 this...

York Region Plan to Support Seniors hosted an information series with John in late 2024. In these recorded sessions, John looks at what people need to know about retiring on a low-income, how to make the most of government benefits and other considerations. Session 1: What “low-income” means...

Low-cost accounts cost a maximum of $4 per month in banking fees. The Government of Canada and certain financial institutions have an agreement to provide low-cost basic banking services. If you meet certain conditions, you may be eligible for a low-cost account at no cost. No-cost accounts have...

The findings in this report highlight the important role of Old Age Security in reducing poverty, with payments under this program making up a large share of annual income for older adults in Toronto’s lowest income deciles. However, too many eligible older adults in Toronto are not receiving OAS...

FSRA’s role as regulator is to ensure pension plans meet the legal standards in the Pension Benefits Act. They can also help you if you can’t get the information you need from your plan administrator or want to file a complaint about your pension plan. Use this website to learn more...

The Nova Scotia Securities Commission has investor education videos covering a range of topics from recognizing frauds and scams to learning more about investing and compound interest. Access this resource to see them...

As Nova Scotia’s population gets older, more people are thinking about, and getting closer to retirement, and many of them have built up a sizable investment portfolio over their lifetime. This has led to older adults in Nova Scotia, and throughout Canada, being targeted by investment fraud and...

Banks in Canada are working around the clock on the prevention and detection of fraud and cyber security threats and work closely with each other and with bank regulators, law enforcement and all levels of government to protect the financial system and their customers from financial crimes. There...

Financial abuse is one of the most common forms of elder abuse in Canada. Learn how to identify and prevent it, plus where to go for help if you or an older person you know is being financially...

As life expectancy in the U.S. increases, older adults will comprise a larger share of the population than ever before. At the same time, older adults will play an increasingly important role in the U.S. economy. Their contributions through consumption, labor, and unpaid activities—such as...

In Canada, governments provide seniors with a spectrum of income supports and programs intended to maintain a baseline standard of living in retirement. For many years, the social safety net has been praised for producing lower poverty rates for seniors, as measured by the Market Basket Measure...

The banking industry has long recognized that it has a role to play strengthening the financial literacy skills of all Canadians. That’s why the CBA administers Your Money Seniors, a free, non-commercial seminar program developed in collaboration with the Financial Consumer Agency of Canada...

The Ontario Securities Commission (OSC) has shared three tax credits seniors should know about: Age amount Disability amount (for yourself) Pension income amount You may also learn more about sharing tax credits and splitting pension income with your...

World Elder Abuse Awareness Day takes place each year on June 15th and is a good opportunity to remind ourselves, friends and family about the importance of recognizing the signs of financial abuse and taking preventative measures. Older adults are often the target of financial abuse, but anyone...

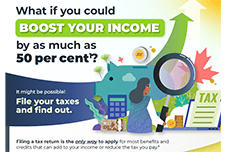

This infographic by community food centres Canada provides a helpful visual summary of tax benefits that can add to income or reduce the taxes Canadians pay when they file their tax return. The information is especially useful for people: Working or living on a low income; Living with a...

The CRA has compiled benefits and credits factsheets for: Students Persons with disabilities Modest income individuals Housing insecure individuals Adults 65 and older Women in shelters Indigenous peoples Newcomers These are available in English and...

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or...

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself,...

This report identifies behaviourally informed techniques dealers and advisers can use to encourage their older clients to provide the necessary information for enhanced investor protection...

Open, honest conversations about money are one of the keys to building a healthy relationship with your family, across the generations. With a little preparation, talking about financial matters can help build trust, deepen connections, relieve stress and lead to greater peace of mind. Yet for...

The Trusted Contact Person initiative has been adopted across Canada. It is part of new regulatory measures to support advisors in their efforts to help investors, particularly older investors and vulnerable, protect themselves and their financial interests. Canadian seniors are increasingly...

In 2021, losses reported to the Canadian Anti-Fraud Centre reached an all time high of 379 million with Canadian losses accounting for 275 million of this. Fraud Prevention Month is a campaign held each March to inform and educate the public on protecting yourself from being a victim of...

These resources from the Ontario Securities Commission are oriented towards planning for retirement. Resources include tips on insurance planning, government benefits, RRSP calculator, and...