Discover financial empowerment resources

Discover financial empowerment resources

The Municipal Innovation Exchange (MIX) project team created this Toolkit to assist municipalities - individual line managers or project owners, or municipal strategic teams (like a Smart Cities Office) - that are contemplating or undertaking a procurement by means of innovation partnership. The...

Our cities and communities are where people live. It is here we see the effects of public policy and it is here where we will address the issues that matter most to Canadians. The choices made today will impact Canada’s recovery from COVID-19. If we want a future where our cities are thriving, we...

The Vibrant Communities – Cities Reducing Poverty 2020 Impact Report is the Tamarack Institute's first attempt at capturing and communicating national trends in poverty reduction and the important ways in which member Cities Reducing Poverty collaboratives are contributing to those changes. This...

The engagement of Canadians with lived experiences of poverty in government consultations on poverty reduction is critical. But as hard as governments work to try to include people living in poverty as full participating members in their consultation processes, there are many barriers that continue...

As the connection between financial capability and social mobility is made evident, both public and private actors are increasingly interrogating the drivers of personal financial health and investing in the innovation of products and services designed to improve the condition of economically...

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics...

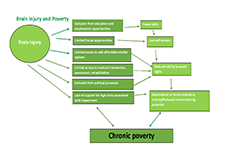

Across Canada, homelessness has always existed but with the creation of statistical reporting across the country the awareness of the pressure this puts on Canadian society is more apparent. The statistics on homelessness are staggering and understanding the path to homelessness, included by those...

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and...

This report is a three-year evaluation of the Financial Empowerment Center initiative’s replication in 5 cities (Denver, CO; Lansing, MI; Nashville, TN; Philadelphia, PA and San Antonio, TX). Financial Empowerment Centers (FECs) offer professional, one-on-one financial counseling as a free...

The Who’s Hungry Report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto. To create the reports, trained volunteers conduct face-to-face interviews with over 1,400 food bank clients at nearly 40 member agencies, collecting demographic data as well...

Understanding the health of the balance sheets of Canadian households is a complex issue that continues to generate considerable discussion. A new Statistics Canada study contributes to these discussions by highlighting the extent to which national measures of indebtedness and wealth mask...

Debt-to-income ratios in Canada have continue to rise since the 2008-2009 recession, especially in urban centres where housing prices have increased over the last few years. This infographic from Statistics Canada shows where debt-to-income ratios are highest across...

In this presentation, German Tejeda, National Director of Financial Programs, Single Stop USA, shares results from the Virtual VITA Program in the United States since 2012. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by...

How has the Vibrant Communities – Cities Reducing Poverty (VC – CRP) network contributed to poverty reduction in Canada? In seeking to answer this central question, the State of Cities Reducing Poverty paper highlights the network’s numerous and varied...

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income...

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer...

This is a brief on the cost of financially insecure families to Chicago, in terms of cost of eviction and unpaid bills. The financial health of cities depends on financially secure residents. When families have little to no savings and experience a disruption in their income or expenses, bills may...

This brief and an accompanying interactive map were commissioned by the New York City Department of Consumer Affairs’ Office of Financial Empowerment. The brief provides information on how many New Yorkers are unbanked and underbanked, recognizing their links to financial health. It also...

These are the webinar slides from the Center for Financial Security webinar on the LIFT-UP program approach to municipal financial empowerment with the National League of...

This overview paper broadly outlines the types of strategies being used to help people move up from poverty. It lays out basic categories for classifying such programs, explains the logic of various approaches, and offers some broad pros and cons of various types of interventions. The accompanying...

Comprehensive research on microfinance and subsidy shows that virtually all microfinance institutions are subsidized, but these subsidies are small. There are two clear paths for increasing microcredit’s impact through continued investment: » Lowering the cost of microcredit by lowering...

Aboriginal women share some of the same demographic and socioeconomic characteristics as other women in Canada; however, there are also many important differences. Generally speaking, Aboriginal people in Canada are defined as three unique and distinct groups: First Nations (North American Indian),...

This second edition of Canadian Demographics at a Glance updates and expands the data and analyses found in the first edition. This compendium is comprised of four sections, beginning in Section one with an overview of Canada’s total population growth, as well as the age and sex structure....

The aim of this scoping review of Canadian literature is to examine how the Canadian public understands these seven key social determinants of health that we identified in Making the Connections and to identify gaps in the public’s understanding of the SODH and the research on this subject. Based...

The report begins by defining and quantifying Canadian financial exclusion and then presents various theories offered to explain it. It then proceeds to provide a set of suggestions as to how banking services can become more relevant for low-income households. Finally, it runs through a set of...