Discover financial empowerment resources

Discover financial empowerment resources

Wealth inequality, health and health equity is one in a series of ongoing think pieces from Wellesley Institute that aim to stimulate ideas and new conversations to create a fairer and healthier tomorrow. Canadians are struggling with the rising cost of living. A national survey in November 2023...

The Future of Wealth Discussion Series consist of 1-hour virtual convenings that are open to the public and bring together leaders across sectors and disciplines to consider wealth-building objectives that Aspen FSP considers critical to creating widespread household financial well-being. Click on...

This presentation at the Canadian Economics Association by Professor Annamaria Lusardi, looks at how we measure financial literacy, how we measure the impact of financial literacy on behaviour, how this data and these findings may be used to design policy and programs and what the implications for...

Recent increases in the cost of living and declining real estate values had unprecedented impacts on net saving and wealth for more financially vulnerable households in the first quarter, such as those with lower incomes, less wealth, and in younger age groups. Statistics Canada has gathered data...

By most measures of economic success—whether it be income, education, wealth or employment—Asian Americans are doing well in the United States, both when compared to other communities of color as well to White households. But while these measures of success are noteworthy, the way they are...

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native...

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their...

The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx,...

This is the second brief in a new series from The Financial Clinic. Change Matters leverages the data gathered through our revolutionary financial coaching platform, Change Machine, alongside the voices, wisdom, and lived experiences of Change Machine customers. We hope that our action oriented...

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: What we know about the health-wealth connection for adults. Why investment in integration is important. How philanthropy can contribute to...

This report examines data from the Federal Reserve System’s 2016 Survey of Consumer Finances to understand how the wealth of median Black, Latino and White families have changed since the findings of its previous survey were released in...

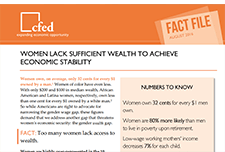

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic...

This new Poverty Trends Scorecard consisting of four reports now presents an update of the information on income, wealth, and inequality. Over three years later, the recovery has yet to fully take hold. The individuals and families who bore the brunt of the 2008–09 recession face continuing...

In this chapter I examine whether and how the relationship between family socioeconomic characteristics and academic achievement has changed during the last fifty years. In particular, I investigate the extent to which the rising income inequality of the last four decades has been paralleled by a...

By 2003, the savings and asset building field had achieved critical research and policy successes. However, some challenges it faced were the lack of a substantial presence of organizations of color in the field and the absence of experts of color at decision-making tables. Over the course of 11...

This is the slide deck from a webinar by Community Action Partnership for the CFED, on the racial wealth divide and the challenge of wealth building for families of color in the United States. Racial Inequality has always had economic inequality at its foundation....

...

The gap between rich and poor is reaching new extremes. Credit Suisse recently revealed that the richest 1% have now accumulated more wealth than the rest of the world put together.1 This occurred a year earlier than Oxfam’s much publicized prediction ahead of last year’s World Economic Forum....

This report focuses on the role that policy design can have on closing the country’s unrelenting and unacceptable racial wealth divide. We utilize a new framework—The Racial Wealth Audit—launched jointly by the Institute on Assets and Social Policy at Brandeis University (IASP) and Demos to...

Good public policy matters and has been effective in reducing child poverty. Indeed, without government transfers over 2 million children would live in poverty. However, to date, policy inputs against poverty have been small and poverty reduction too limited. History has shown us that no one-off...

We define precarious employment as having an outsized level of uncertainty, whether in terms of pay, ongoing employment, scheduling, or other dimensions. Types of work associated with precarious employment are typically lower paying, with an income gap of between $11,600 and $18,000 in 2014...

The federal government’s decision this year to cancel family income splitting and lower the annual contribution limit for tax-free savings accounts was driven largely by concerns about income inequality. Research by the Canadian Centre for Policy Alternatives, Parliamentary Budget Officer and...

This is a brief presentation by Ray Boshara from the Federal Reserve Bank of St. Louis. It shows data from the Survey of Consumer Finances "financial health scorecard." Results show the disparities in wealth for already vulnerable families, and differences by age, ethnicity, and education. No...

A substantial number of immigrants are not only blocked from entering the professions for which they trained and were then recruited to Canada, but a substantial portion of them are not in any type or form of secure employment. Instead, Canadian newcomers often face substandard, precarious and...

Approximately 2 million Ontarians live in low-income households, many allocating a significant portion of their finances to powering their homes. In these situations, electricity costs can force individuals to have to decide between paying energy bills and providing for other essential food,...