Discover financial empowerment resources

Discover financial empowerment resources

In recognition of November 2025 Financial Abuse Awareness month, the Canadian Center for Women's Empowerment (CCFWE) hosted Empowering Survivors Through Digital Safety: Preventing Technology-Facilitated Economic Abuse within Financial Systems. This webinar explores how survivor-informed policy,...

Many Canadians assume that poverty among seniors is a minor issue. That the income security system provides enough for the elderly to live with dignity. But this new report reveals a different reality: 430,000 seniors in Canada live below the Official Poverty Line. Why does seniors’ poverty...

This groundbreaking initiative is aimed at transforming emergency shelter services across Canada to better uphold the rights of women and gender-diverse people. Emergency shelters play a critical role in providing immediate support, but they are often overwhelmed and under-resourced. In response...

The British Columbia Securities Commission’s InvestRight has unveiled an online space dedicated to women and investing. This comprehensive guide to investing, called Women and Investing, features quizzes and resources explicitly designed to engage more women in investing. To assist you in...

Despite the fact the story is three years old, it made the rounds online again, and it's also still valid. Indigenous women are starting new businesses at twice the rate as Indigenous men, but they face significant barriers to accessing funding. This is something that hurts everyone -...

Gender-based violence (GBV) is one of the most prevalent human rights issues in the world. Worldwide, an estimated one in three women will experience physical or sexual abuse in her lifetime. GBV is a multifaceted issue that undermines the health, dignity, security and autonomy of women and has a...

There are many effective, award-winning financial literacy programs in Canada. However, many of these programs do not meet the needs of women living on low incomes. Families Canada’s national research study identified 14 social, economic, and institutional barriers that prevent women living on...

Families Canada’s report Financial Empowerment for Women Living on Low Incomes: An Action Plan shares 20 calls to action for adapting financial literacy programming to better support women living on low incomes. To help fulfill some of the calls to action outlined in the report, they’ve just...

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help...

Using data primarily from the 2021 Canadian Housing Survey, this study applies a gender lens to examine the characteristics of Canadians living in subsidized housing. It examines the experiences of renters in subsidized housing and their satisfaction with their dwelling and neighbourhood, drawing...

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of...

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day...

This study uses the 2022 Portrait of Canadian Society Survey to examine the impact of rising inflation on the lowest income Canadians. Using multiple pre-pandemic data sources, the study takes a closer look at people living in the bottom family income quintile, examining their family income, debt...

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey...

This webinar hosted by FCAC (originally broadcast on November 17, 2021) targets women who want to learn more about managing money and building saving habits. Guest speaker, personal financial expert, Rubina Ahmed-Haq has also contributed to Canada's financial literacy blog on "Women face unique...

The evolution of the wealth, assets and debts of various groups of Canadians since the late 1990s has been documented in several studies. Yet little is known about the evolution of the wealth holdings of unattached men and women aged 50 and older, who make up a large part of the population. This...

In 2019, non-profit organizations (NPOs)—serving households, businesses and governments—employed 2.5 million people, representing 12.8% of all jobs in Canada. The employment share ranged between 12.4% and 12.8%, increasing during the 2010-to-2019 period. While the economic and social...

The effects of the COVID-19 pandemic have been profound and far-reaching. Beyond endangering the health of Canadians, the pandemic has worsened inequalities among groups of people. Women, girls and gender-diverse people have faced unique challenges during the pandemic. The Committee recommends...

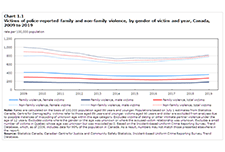

Family violence in Canada: A statistical profile is an annual report produced by the Canadian Centre for Justice and Community Safety Statistics at Statistics Canada as part of the Federal Family Violence Initiative. Since 1998, this report has provided data on the nature and extent of family...

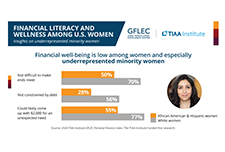

This paper provides an in-depth examination of the financial well-being of Black and Hispanic women and the factors contributing to it, using the 2018 wave of the National Financial Capability Study. Differences between Black and Hispanic women versus White women are documented, in that the former...

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response...

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined...

AFN’s latest report, in collaboration with the Closing the Women’s Wealth Gap (CWWG) and the Insight Center for Community Economic Development reveals the current economic reality for millennial women and the primary drivers contributing to their wealth inequities. The report, Clipped...

The economic fragility of single women 45-65 years of age is growing, states AFN’s report, On Shaky Ground: Stabilizing the Financial Security of Single Women, released in collaboration with Closing the Women’s Wealth Gap Initiative (CWWG). This report is the first in a series that builds off...

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age...