Discover financial empowerment resources

Discover financial empowerment resources

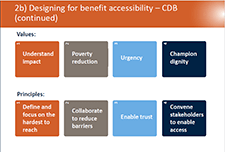

In this webinar you will learn about the barriers facing people with disabilities in accessing benefit programs and the work currently underway to identify, influence and pilot solutions to help advance the access to benefits process now and in the future. This webinar includes: - An...

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to...

This toolkit contains resources and information which may offer support to organizations, agencies, or frontline staff supporting individuals, during a challenging time. This toolkit has been made possible with the support of the Canadian Investment Regulatory Organization (CIRO) and is now...