Discover financial empowerment resources

Discover financial empowerment resources

Rising housing costs have had an impact on the ability of families to move. This article, using data from the Canadian Social Survey (CSS), illustrates how higher prices have disproportionately affected the moving decisions of young Canadians, particularly those experiencing financial...

This 90-minute webinar provides frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and opportunities for...

This 90-minute webinar provided frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learned the importance of access to benefits for individuals and families, reviewed key skills and opportunities for...

The COVID-19 pandemic and post-pandemic recovery were “feast and famine” for the budgets of low-income families and individuals across Canada. Because of the income support programs put in place to help Canadians affected by workplace shutdowns, the poverty rate fell to 6.4% in 2020, down by...

The Working Centre in Kitchener-Waterloo has been dedicated to aiding marginalized populations for over 40 years. In partnership with Prosper Canada, it embarked on an initiative to connect the populations they serve to government benefits and tax filing support. Recognizing the intricate...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

This year marks the 35th anniversary since the passing of the unanimous all-party federal resolution to end child poverty in Canada by the year 2000. Using tax filer data from 2022, the latest available, this year’s report card found a troubling trend: child poverty increased at record rates two...

This 40-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

When fraudsters invest time to get as much of your money as possible it’s called “pig butchering”. Just as a farm animal is fattened up before being sold to market, pig butchering scammers take a long-haul approach to get what they want from victims. Find out more about these scams and how...

This 90-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

In their study, entitled, “Experiences of Financial Stress and Supports in Caregivers During Pediatric Hospital Admission,” Nadarajah et al interviewed caregivers of children admitted to a pediatric hospital and conducted qualitative analyses to assess financial needs, health related financial...

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility...

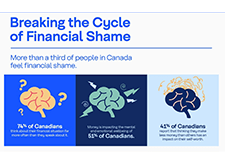

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

Community organizations play a vital role in supporting people. In these difficult economic times, helping community members strengthen their financial literacy and build their financial resilience is essential for helping them to navigate financial challenges. Building on Financial Consumer...

Families Canada’s report Financial Empowerment for Women Living on Low Incomes: An Action Plan shares 20 calls to action for adapting financial literacy programming to better support women living on low incomes. To help fulfill some of the calls to action outlined in the report, they’ve just...

There are many effective, award-winning financial literacy programs in Canada. However, many of these programs do not meet the needs of women living on low incomes. Families Canada’s national research study identified 14 social, economic, and institutional barriers that prevent women living on...

ABC Life Literacy Canada has unveiled the newest workbook from its HSBC Family Literacy First program, supported by HSBC Bank Canada. The workbook, entitled “Chug-a Chug-a Choo Choose”, includes a story and four new activities that teach children how to compare costs and identify needs and...

Food insecurity—the inadequate access to food due to financial constraints—affects 1 in 6 households in Canada, with serious health implications. Family benefit programs supplementing income have shown potential in mitigating the risk of food insecurity, but there is little understanding of...

Trauma and violence are highly prevalent and have serious impacts on health and well-being. Being aware of how trauma and violence can present during service interactions can improve their effectiveness and client and provider satisfaction and well-being. Financial literacy educators are...

Canada’s tax system has a punitive impact on lower income families with children hoping to earn more money, according to a new report from the C.D. Howe Institute. In “Softening the Bite: The Impact of Benefit Clawbacks on Low-Income Families and How to Reduce It,” authors Alex Laurin and...

Daily aspects of Canadians' lives are increasingly touched by digital technology, and access to high-speed Internet has become an essential service and a key driver for improving our economic and social well-being. The Government of Canada originally announced Connecting Families in Budget 2017 to...

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools,...