Discover financial empowerment resources

Discover financial empowerment resources

There are many different actions that can be taken to improve financial wellbeing. The Financial Wellbeing Framework offers 17 entry points to action to inform government, organizations, policymakers, decision-makers, practitioners, and researchers in their efforts to address financial...

Braiding Mind, Body, and Spirit: A Financial Wellness Bundle is a resource designed to help Indigenous individuals, families, and communities make confident money choices with settlement funds. This 60-minute webinar brought together the co-creators of the resource to highlight the need for...

Canadians with low incomes lack access to the financial help they need to rebuild their financial health and resilience. Watch the webinar from September 17, 2025 as we present findings from our recent report: Closing the Divide: Solutions for Canada’s Financial Help Gap. Prosper Canada’s...

A culturally grounded resource to support Indigenous financial wellness. Braiding Mind, Body, and Spirit is a financial wellness bundle created by and for Indigenous individuals and communities. Developed with Indigenous teachings, community voices, and practical tools to support individuals,...

The GetYourBenefits! Project began as an attempt to convince physicians that it is important to diagnose and treat poverty. This paper describes how information on accessing benefits has been communicated to physicians, health care providers, and those who work in public...

Dive in to explore how the trends and insights from the country’s most comprehensive research on non-profit workers’ health and wellbeing can guide your leaders, team and board. The 2025 Changemaker Wellbeing Index is a free resource filled with reliable data on the factors affecting the...

From 2019 to 2022, among Indigenous people aged 18 years and older, 54.3% of Inuit reported having a regular healthcare provider, along with 81.4% of First Nations people living off reserve and 84.5% of Métis. This is compared with 85.7% of the non-Indigenous adult population. Released...

This article analyses results from the Canadian Housing Survey, 2022 , using new variables on homelessness and factors contributing to regaining and maintaining housing. The paper provides a descriptive overview of different types of homelessness experiences in Canada, highlighting select...

In 2024, close to half of First Nations people living off reserve (45%) and Métis (44%), and more than half of Inuit (54%) (all aged 15 years and older) reported that it was "difficult" or "very difficult" in the 12 months preceding the survey to meet their financial needs in terms of...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

In partnership, Daily Bread Food Bank and North York Harvest Food Bank have released Who’s Hungry 2024 – an annual profile of poverty and food insecurity in the City of Toronto. In the last year, there were 3.49 million client visits to Toronto food banks – nearly 1 million more visits...

Burnout can happen for many reasons, including being overworked. Dealing with stress can cause problems for your physical and mental health, and your finances. If you’re over-spending or making spontaneous decisions about money to cope with stress, you might be putting your long-term financial...

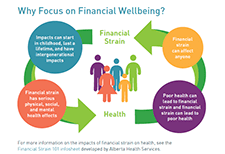

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

Savings are one of the strongest predictors of household financial resilience and well-being, yet Canadian households struggle to save due to an array of economic, behavioural and institutional factors. The Financial Consumer Agency of Canada (FCAC) created the National Financial Literacy...

Wealth inequality, health and health equity is one in a series of ongoing think pieces from Wellesley Institute that aim to stimulate ideas and new conversations to create a fairer and healthier tomorrow. Canadians are struggling with the rising cost of living. A national survey in November 2023...

In their study, entitled, “Experiences of Financial Stress and Supports in Caregivers During Pediatric Hospital Admission,” Nadarajah et al interviewed caregivers of children admitted to a pediatric hospital and conducted qualitative analyses to assess financial needs, health related financial...

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. The 2023...

This study examined the financial lives of retired Canadians and those approaching retirement. While most retired Canadians said they are in a strong financial position, a concerning 15% of retirees rated their financial situation as poor. Almost one third of retirees reported their monthly...

Gender-based violence (GBV) is one of the most prevalent human rights issues in the world. Worldwide, an estimated one in three women will experience physical or sexual abuse in her lifetime. GBV is a multifaceted issue that undermines the health, dignity, security and autonomy of women and has a...

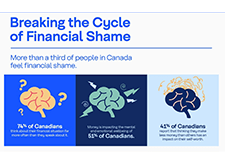

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

In time for Financial Literacy Month, the Financial Consumer Agency of Canada has released several resources on their website. Checking up on your progress in managing and paying down debt is an important part of maintaining your overall financial health. This infographic outlines how to...

This is the 2023 report on the progress of Opportunity for All – Canada’s First Poverty Reduction Strategy (PRS). While COVID-19 still threatens communities in Canada and around the world, the public health measures have largely been lifted. Temporary economic measures have also ended. At the...

This is a custom report produced by Statistics Canada in collaboration with the Assembly of First Nations. It includes key social and economic statistics regarding Status First Nations people living on and off reserve and includes comparisons with the non-Indigenous...

November 26 is National Economic Abuse Awareness day. The Canadian Centre for Women's Empowerment has published their report on the state of economic abuse in Canada; championing financially strong futures for survivors. Here are some additional resources of potential interest: The economic...