Discover financial empowerment resources

Discover financial empowerment resources

How we define financial vulnerability ultimately determines what supports are created and for whom. Is the current definition aimed at helping everyone who needs it? This webinar explores the conception and redefining of financial vulnerability in Canada based on the research and findings from the...

This report examines how diary participants achieve the financial wellbeing that they have. The evidence we found is that low-income people work very hard to manage their finances. They endeavor to control their finances so that, as one participant said, their finances don’t control them. They...

The Canadian Financial Diaries Research Project is using the financial diaries methodology to understand the financial dynamics of vulnerable Canadians in a rapidly changing socio-economic context. This includes understanding the barriers and opportunities that people face in trying to improve...

Through the Group RESP Research and Education Project, SEED Winnipeg, Momentum (Calgary), the Legal Help Centre of Winnipeg, and an interdisciplinary research team studied the regulation of group plan RESPs and the experiences of low-income subscribers, and developed public legal education...

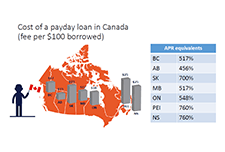

This webinar, "High cost lending in Canada: Risks, regulations, and alternatives," is about why high cost lending products are concerning, especially for financially vulnerable Canadians. Speakers discuss what is driving the use of these products, what kind of regulations are involved, and what...

This is a presentation by Jerry Buckland at the AFOA Canada Conference in February 2017. It covers: 1.An Indigenous Financial Wellness Framework: demonstrates the need to boost capability and inclusion; 2.Results from a Manitoba case study of financial exclusion; 3.Lessons from abroad: the...

Financial exclusion is a matter of growing concern in Canada considering the decline in the number of mainstream bank branches in some inner-cities and the concurrent rise in the number of fringe banks. This study reports on results from a survey of residents from Winnipeg’s North End, a...

Concern about financial literacy is rising. But national surveys of financial literacy are not very helpful regarding the literacy characteristics of the poor. This case study uses the financial diary method to examine the financial literacies of 13 poor Canadians. The results found that most...

This report presents an analysis of a survey of financial service choice of residents of low-income inner-cities in Toronto, Winnipeg and Vancouver. The survey was administered in 2006-07 with 83 residents and asked them quantitative and qualitative questions about their financial service options...

The report begins by defining and quantifying Canadian financial exclusion and then presents various theories offered to explain it. It then proceeds to provide a set of suggestions as to how banking services can become more relevant for low-income households. Finally, it runs through a set of...