Discover financial empowerment resources

Discover financial empowerment resources

The findings in this report highlight the important role of Old Age Security in reducing poverty, with payments under this program making up a large share of annual income for older adults in Toronto’s lowest income deciles. However, too many eligible older adults in Toronto are not receiving OAS...

York Region Plan to Support Seniors hosted an information series with John in late 2024. In these recorded sessions, John looks at what people need to know about retiring on a low-income, how to make the most of government benefits and other considerations. Session 1: What “low-income” means...

In this 8th episode of the "What the Food?!" webinar series, we hear from Randy Hatfield, Executive Director at the Saint John Human Development Council about affording food in today's economy - the living wage vs minimum wage, the Consumer Price Index, rental rates and the salary requirements to...

Working poverty is pervasive, racialized, and until the pandemic, was increasing in Toronto and across Canada. Until the pandemic, this increase was counterintuitive, during 2006 to 2016, as most of this ten-year period had been characterized by one of the most prolonged economic recoveries in...

In this blog, John Stapleton breaks explains income security and personal tax systems in Canada in the simplest way...

This collection of financial empowerment tools and resources is intended to support both Indigenous and non-Indigenous organizations working to build financial wellness in First Nation communities. It was created as part of the Financial Wellness in First Nations project (2021-2023) where...

According to Employee Benefit Research Institute (EBRI), workers with household incomes of $75,000 or more are more than twice as likely to say they feel they can handle an emergency expense than those with household incomes of less than $35,000. This report outlines the results of the 2022 survey...

Recover and Rebuild: Helping Canadians build financial security during the pandemic and beyond The 2021 ABLE Financial Empowerment (FE) virtual series is a collection of online financial empowerment events designed to provide frontline FE practitioners, FE stakeholders, policy-makers and...

Financial planners and advisors want to better the lives of the people they work with, but may not know that conventional retirement advice often doesn’t work for low-income retirees. Getting it right when every dollar counts The advice that works well for higher- and middle-income clients can...

This booklet contains information on retirement planning on a low income. Topics include four things to think about for low income retirement planning, a background paper on maximizing the Guaranteed Income Supplement (GIS), and determining Old Age Security (OAS) and GIS eligibility for people who...

NB Social Pediatrics and the Saint John Community Loan Fund recently surveyed 157 New Brunswick and Nova Scotia residents about their experiences with finances, banking, and ID to better understand if biometrics or ID banks could be effective solutions for people living without ID. Eyeing the...

This policy backgrounder provides an overview of how provincial and territorial governments have decided to treat receipt of the Canada Emergency Response Benefit (CERB) for those receiving social assistance and/or living in subsidized housing. It also looks at provisions for youth aging out of...

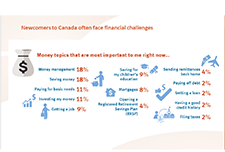

For many newcomers, living in Canada involves learning about finances and money management in new ways. This can include navigating new financial systems, and learning about tax filing and benefits, as well as day-to-day money management and saving. One-on-one financial coaching programs...

The engagement of Canadians with lived experiences of poverty in government consultations on poverty reduction is critical. But as hard as governments work to try to include people living in poverty as full participating members in their consultation processes, there are many barriers that continue...

In this presentation, John Silver, Executive Director, Community Financial Counselling Service (CFCS), Winnipeg, shares insights from the low income tax program at CFCS. This program files almost 10,000 returns each year, and also provides tax clinic support to other agencies and delivers detailed...

The research symposium "Overcoming barriers to tax filing for people with low incomes" was held in Ottawa on Thursday, February 7, 2019, hosted by Prosper Canada and Intuit. The symposium presents research results and insights from practitioners in the field on barriers to tax filing experienced...

This is a one-hour webinar on matched savings programs and personal savings strategies that work for people living on low incomes. Our panelists share experiences from their programs in Ontario and Calgary. The presenters in this webinar are: Dean Estrella, Momentum, Calgary, AB John...

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income...

We characterize rates of intergenerational income mobility at each college in the United States using administrative data for over 30 million college students from 1999-2013. First, access to colleges varies greatly by parent income. Second, children from low and high-income families have very...

This is an editorial opinion written by J. Michael McGinnis, MD, MPP, on findings by John Hopkins Boomberg School of Public Health connecting life expectancy with income level. It has long been known from national-level data that incomes and standards of living are associated with life expectancy,...

Students spend a significant portion of their day in school – and as a result, schools can offer these students a safe and consistent place to study and access to caring adults who can help them navigate some of the challenges they face. In an otherwise chaotic time of homelessness, schools can...

This report estimates the price of inaction. Regardless of the strategy used to address poverty, it asks, “What does it cost us to allow poverty to persist in Toronto?” It estimates how much more we may be spending in the health care and justice systems simply because poverty exists, and how...

This report examines the relationship between the earnings of Canadians in the labour market and their post-secondary education credentials. Findings are based upon information gathered from the 2016 Census on adults between the ages of 25 to 64 with different levels of education and working in...

This presentation covers information about retiring on a low income in Ontario. It covers: 1. What seniors get in Ontario 2. What does ‘low income’ mean? 3. What does ‘taxable income’ mean? 4. How to reduce taxable income or get money back ─ understanding the system 5. Protecting...

This is a webinar presentation recorded with John Stapleton at Prosper Canada on October 4th, 2016. John Stapleton is a Principal of Open Policy, and has worked for the Ontario Government for 28 years in the areas of social assistance policy and operations. In the session John describes the...