Discover financial empowerment resources

Discover financial empowerment resources

Between the high cost of living and inflation, many of us are struggling with debt. But with financial advice available everywhere - from your uncle’s friend to social media influencers, it can be easy to feel overwhelmed and hard to know whose advice you can trust. Learning some key warning...

The Office of the Superintendent of Bankruptcy (OSB) is continuing its efforts to help Canadians experiencing serious financial difficulties find the right debt solution. These efforts include increasing consumer awareness about the unregulated Debt Advisory Marketplace and helping consumers...

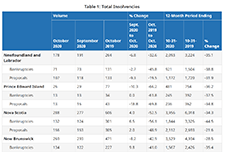

The Office of the Superintendent of Bankruptcy Canada releases statistics on insolvency (bankruptcies and proposals) numbers in Canada. The latest statistics released on November 4, 2020 show that the number of insolvencies in Canada increased in the third quarter of 2020 by 7.9% compared to the...

There are many options to deal with debt, but if it sounds too good to be true—it probably is. Ask questions and shop around to avoid paying unnecessary fees. The Office of the Superintendent of Bankruptcy Canada has put together a host of useful tools around debt based on an individual's...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

This toolkit contains resources and information which may offer support to organizations, agencies, or frontline staff supporting individuals, during a challenging time. This toolkit has been made possible with the support of the Canadian Investment Regulatory Organization (CIRO) and is now...