Discover financial empowerment resources

Discover financial empowerment resources

This 90-minute webinar provides frontline practitioners with foundational knowledge and skills to support Canadians living on a low income in accessing benefits. Participants will learn the importance of access to benefits for individuals and families, review key skills and opportunities for...

This 90-minute webinar provided frontline practitioners with foundational knowledge and skills to support Canadians living on a low income in accessing benefits. Participants learned the importance of access to benefits for individuals and families, reviewed key skills and opportunities for...

If any of these statements sound like something you would say about money, this toolkit is for you: • I don’t have enough money to live on each month. • I find it frustrating to have to share my situation over and over again. • I wish I could find help easily but don’t know where to...

Prosper Canada's comprehensive report, Closing the Divide: Solutions for Canada's Financial Help Gap, sets out clear steps governments, financial services, and community organizations can take to ensure every Canadian – no matter who they are or where they live – can access the financial help...

Braiding Mind, Body, and Spirit: A Financial Wellness Bundle is a resource designed to help Indigenous individuals, families, and communities make confident money choices with settlement funds. This 60-minute webinar brought together the co-creators of the resource to highlight the need for...

Canadians with low incomes lack access to the financial help they need to rebuild their financial health and resilience. Watch the webinar from September 17, 2025 as we present findings from our recent report: Closing the Divide: Solutions for Canada’s Financial Help Gap. Prosper Canada’s...

A culturally grounded resource to support Indigenous financial wellness. Braiding Mind, Body, and Spirit is a financial wellness bundle created by and for Indigenous individuals and communities. Developed with Indigenous teachings, community voices, and practical tools to support individuals,...

Buy Now Pay Later apps like Klarna and Afterpay have become ubiquitous since the pandemic, allowing users to pay for items in small installments over time instead of footing the bill all at once. But now, some financial experts are sounding the alarm that these easy-to-use apps can lead to...

The Embedded Financial Coaching project builds on evidence that embedding financial coaching into employment services leads to stronger employment and financial well-being outcomes. This report provides insights on the project components including delivering financial coaching services, developing...

The Working Centre in Kitchener-Waterloo has been dedicated to aiding marginalized populations for over 40 years. In partnership with Prosper Canada, it embarked on an initiative to connect the populations they serve to government benefits and tax filing support. Recognizing the intricate...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

This 40-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

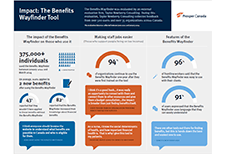

The external evaluation firm, Taylor Newberry Consulting, evaluated the Benefits Wayfinder between June 2022 and January 2024. This infographic showcases the feedback received based on feedback collected from 500 users and over 35 organizations across Canada. Impact: L'orienteur en mesures...

This 60-minute webinar for frontline practitioners, social service providers, and funders shares insights from a two-year project designed to help build financial wellness in isolated and rural First Nation communities in Manitoba and Ontario. Partnerships between First Nation communities and...

This 90-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

If you work with people in Canada living on low incomes, you can play a meaningful role in supporting access to benefits regardless of your expertise or sector. Prosper Canada identified 36 barriers that individuals living on low incomes face when trying to access benefits. More than half of the...

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

This report provides insights from the project, including highlighting the challenges people with disabilities in British Columbia face in their journey to get income benefits, the opportunities to remove those barriers and implications for future benefits design. The demand for access to benefits...

Community organizations play a vital role in supporting people. In these difficult economic times, helping community members strengthen their financial literacy and build their financial resilience is essential for helping them to navigate financial challenges. Building on Financial Consumer...

This toolkit was created to support the Virtual Self Filing tax filing model piloted in 2020-2022 by Canadian community agencies. In this model, individuals file their own tax returns, but receive support from community agency staff or volunteers to do so. In 2023, this toolkit was updated to...

Increasing Access to Benefits for Peoples with Disabilities project - Insights and Recommendations This 60-minute webinar for front line practitioners and government agencies shares the insights and recommendations from the three-year Increasing Access to Benefits for Peoples with Disabilities...

Organizations play a vital role in providing community members with access to benefits. Tax clinics, homeless shelters, food banks, health centres and others can all do their part to provide these services. This free 60-minute demonstration will showcase our new Bridge to Benefits tool which...

This webinar provides frontline practitioners with recently created tools to support Canadians who are living on a low income to manage their money and learn about saving and investing. Participants will be taken on a guided tour of our new Making the most of your money online course and then...

A recent Prosper Canada report shows that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere...

When Canadians have a financial problem, want to make a financial plan, or need help with their taxes, most simply reach out to their financial institution, adviser, accountant, or commercial tax preparer for the help they need. But who do low-income individuals turn to? A new report by Prosper...