Discover financial empowerment resources

Discover financial empowerment resources

The Expanding Economic Opportunity Through Volunteer Income Tax Assistance (EEOVITA) cohort has been working to identify and engage targeted, underserved populations most at risk for missing out on the expanded Child Tax Credit (CTC) benefit. This project, which began in January 2022 and concludes...

The Multiplying Movement: The State of the Children’s Savings Field 2022 shares findings from Prosperity Now’s 2022 Children’s Savings Account (CSA) program survey. The report highlights the incredible growth of the field with over 4.9 million children and youth with CSAs across the US. In...

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits....

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their...

This document is a compilation of best practices and recommendations from a wide range of resources that Prosperity Now’s Racial Wealth Divide Initiative (RWDI) and Communications teams thought would be helpful for naming, framing, defining and understanding the issue of racial economic equity....

Prosperity Now has created state-level Cost-of-Living profiles as new features on their Scorecard website. The Prosperity Now Cost of Living profiles provide a comprehensive look at the financial stability of every person living in the United States. Each state profile can be downloaded and used to...

These calls, featuring guest practitioners, cover a variety of topics most pressing to the financial coaching field, provide useful tips and resources and serve as a peer-learning platform. Topics include: Financial Coaching Program Design Guide (2/28) - The Role of Financial...

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound,...

By most measures of economic success—whether it be income, education, wealth or employment—Asian Americans are doing well in the United States, both when compared to other communities of color as well to White households. But while these measures of success are noteworthy, the way they are...

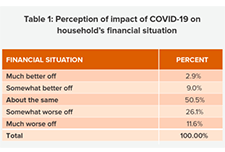

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with...

Tips and considerations for providing alternative tax filing service...

Considerations and best practices for drop-off and virtual tax filing...

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to...

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how...

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife...

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the...

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and...

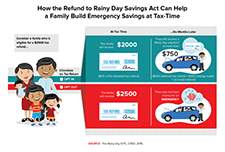

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial...

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from...

This is Prosperity Now’s Taxpayer Opportunity Network VITA Volunteer Training platform, designed to help VITA volunteers (in the United States) train and become certified to provide free tax preparation services. These resources can provide a complete training or supplement the training offered...

In this brief, we articulate why collaboration between community foundations and CSA programs is in their mutual interest. We describe the variety of roles that community foundations can play in promoting the growth and success of CSA programs, and then identify the primary challenges encountered...

This comprehensive resource from Prosperity Now supports organizations in developing a participant-centered financial coaching program. Grounded in a field survey, over 100 interviews, expert advice and beta-testing with six new financial coaching programs, the Coaching Guide highlights the...

This report examines the growing racial wealth divide for Black and Latino and the ways that accelerating concentrations of wealth at the top compound and exacerbate this divide. It looks at trends in wealth...

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low...

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income...