Discover financial empowerment resources

Discover financial empowerment resources

Tables for 14 indicators in Canada's Quality of Life Framework have been updated to include Canadian Social Survey data collected from October to December 2024 (fourth quarter of 2024). These indicators include life satisfaction, sense of meaning and purpose, future outlook, loneliness,...

Financial Services Regulatory Authority is responsible for registering all federally incorporated loan and trust companies that do business in Ontario. They enforce the Loan and Trust Corporations Act that govern loan and trust companies. Use this website to learn more about: How to find a...

The CRA's Indigenous strategy takes inspiration from the United Nations Declarations on the Rights of Indigenous Peoples and contributes to the Government of Canada’s efforts to advance reconciliation. It presents an integrated approach to improve trust and ensure that our services are...

Fraudsters are master manipulators who leverage relationships to build trust and exploit you financially. Technology makes it easy to become a victim as bad actors can, pretend to be someone you know online, or use artificial intelligence to trick you. According to data from the Canadian Anti-Fraud...

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

FAIR Canada engaged The Strategic Counsel (TSC), a national market research firm, to undertake focus groups to better understand Canadian investors. The overall purpose of this research is to provide a broad portrait of Canadian investors including their knowledge, attitudes, behaviours, and...

Between the high cost of living and inflation, many of us are struggling with debt. But with financial advice available everywhere - from your uncle’s friend to social media influencers, it can be easy to feel overwhelmed and hard to know whose advice you can trust. Learning some key warning...

People save for different reasons. For instance, you may want to save for emergencies, or for your children’s education, or for your old age. Having goals for your savings helps to keep you motivated. You sleep better knowing you have some money set aside. Saving accounts earn interest. That...

Research shows that 15 percent, or close to five million Canadians, are underbanked, and three percent are completely unbanked, meaning that they have very limited or no access to financial services within the traditional banking sector. Ironically, underbanked individuals often come from...

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open...

The Better Business Bureau Institute for Marketplace Trust (BBB Institute) is the 501(c)(3) educational foundation of the Better Business Bureau (BBB). BBB Institute works with local BBBs across North America. This report uses data submitted by consumers to BBB Scam Tracker to shed light on how...

This article uses data from a recent crowdsourcing data initiative to report on the employment and financial impacts of the COVID-19 pandemic on Indigenous participants. It also examines the extent to which Indigenous participants applied for and received federal income support to alleviate these...

The House of Commons Finance Committee recently released its call for pre-budget consultation briefs as the government considers its policy priorities for the 2021 federal budget. This toolkit created by Imagine Canada provides information on the reasons to submit a pre-budget consultation...

There are many options to deal with debt, but if it sounds too good to be true—it probably is. Ask questions and shop around to avoid paying unnecessary fees. The Office of the Superintendent of Bankruptcy Canada has put together a host of useful tools around debt based on an individual's...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

Delivered in partnership with Plan Institute, this webinar "Future planning tips for people with disabilities and those who support them," discusses how planning for A Good Life can lead to achieving greater peace of mind about the present. This webinar also introduces the online Future Planning...

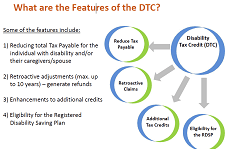

In this webinar, "How to deliver financial supports for people with developmental disabilities," you will learn about financial supports and government programs for people with disabilities in Canada. The topics covered include: social assistance programs, the Disability Tax Credit and other...

This discussion paper responds to a request from ESDC to develop options for reforms to the Canada Education Savings Program and, more specifically to improve access to the Canada Learning Bond. It reviews individual and institutional challenges to participation in the current system and consider...

This guide informs on power of attorney as a legal aspect of financial literacy. Power of Attorney is a legal document that gives another person the power, or right, to make decisions for you. The person you authorize to make decisions for you is called the attorney. The attorney should be someone...

Moving to a new country is exciting, but there's no denying that it comes with its own unique set of challenges. This infographic shows results from the Money Talk For Newcomers Poll by TD Canada...

Millennials (loosely defined here as those born between 1980 and 2000) are often characterized as facing tougher labour market conditions and homeownership barriers, despite being the most highly educated generation in history. However, Canadian millennials are faring better economically than is...

All banks, and trust, loan and insurance companies and retail associations that are federally regulated (or that are incorporated at the federal level) must have a complaint-handling process in place for individuals and small businesses. This process details how a customer may make a complaint, and...

This is a guide to opening an RESP for education savings in Canada. You can open an RESP at almost any financial institution—including a bank, trust company or credit union—or an investment or scholarship plan dealer. You can open an RESP as soon as the child is born. The money in the plan...

Aboriginal individuals, entrepreneurs and communities have been affected by financial literacy challenges in many of the same ways that lower-income people and remote populations in Canada have. However, there is the additional weight of specific cultural and structural barriers and the additional...