Discover financial empowerment resources

Discover financial empowerment resources

The tools provided by Autorité des marchés financiers can help guide financial planning for you and your...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

Fast facts: More than 99 per cent of Canadians have a bank account 31 per cent of Canadians say they pay no service fees at all and another 45 per cent pay $15 or less per month Canadians are careful borrowers. Only 0.17 per cent of mortgages are in arrears Access this resource to read...

A credit card allows you to borrow a pre-approved amount of money. It may help you pay for goods and services. When using a credit card, you must pay your minimum payment by the due date. If you don’t pay your balance in full, your credit card issuer usually charges an interest fee. Credit card...

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money....

In honor of Black History Month, BestColleges in the United States interviewed financial expert Terrance Dedrick to help curate a financial literacy resource for Black and African Americans. This article includes links to these organizations in the United States that cater to Black and African...

Your credit card can help you make purchases quickly without needing to have cash on hand. Follow these tips by the Ontario Securities Commission to use your credit card...

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself,...

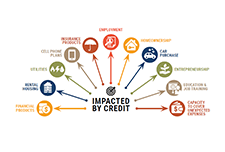

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that...

The Thriving or Surviving study uncovers the kitchen table issues that confront Canadians daily, revealing how the country is coping with concerns such as debt, savings, emergency funds and financial...

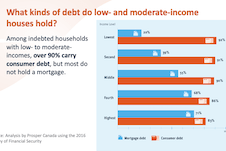

Household debt levels in Canada have been rising since the 1990s, which poses increasing risks for Canada’s economy and Canadians’ financial health. However, the debt ‘picture’ for an average low- or moderate-income household is likely to be quite different from higher income...

This report documents the early effects of the COVID-19 pandemic on credit applications, which are among the very first credit market measures to change in credit report data in response to changes in economic activity. Using the Bureau’s Consumer Credit Panel, how applications for auto loans,...

This report explores the financial services complaint experiences of Canadians at various income levels who used the Ombudsman for Banking Services and Investments (OBSI)’s service. The national, not-for-profit organization collected demographic and case data for almost 1,000 closed cases...

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In...

This tool from the Financial Consumer Agency of Canada will help you compare different payment options to pay off your credit card balance. statement. If you can't, you can still reduce the amount of interest you will have to pay. The credit card payment calculator compares 3 different payment...

Your Money Seniors is a financial literacy program for seniors. Modelled on the CBA’s highly successful Your Money Students program, this seminar program is offered in French and English, free of charge, to seniors’ groups across the country. Your Money Seniors is presented by bankers in...

This handout is from Module 6 of the Financial Literacy facilitator curriculum. The cost of credit for different payment...

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The features of credit cards and what they mean. To view full Financial Literacy Facilitator Resources, click...

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The different types of credit and their lending conditions. To view full Financial Literacy Facilitator Resources, click...

The JPMorgan Chase Institute has assembled data assets and perspectives on income and spending volatility over the last three years and examined the impacts of extraordinary income changes from job loss and extraordinary expense changes, notably from medical payments. Here we take a holistic view...

Using a dataset covering one quarter of the U.S. general-purpose credit card market, we document that 29% of accounts regularly make payments at or near the minimum payment. We exploit changes in issuers' minimum payment formulas to distinguish between liquidity constraints and anchoring as...

To test out the impact of rules of thumb in helping consumers decrease their credit card debt, the CFPB commissioned a rigorous study of two financial rules of thumb on consumers with revolving credit card debt. We created two new guidelines aimed at aiding consumers to decrease their revolving...

This is a financial planning guide developed by OCAD Financial Aid, to help art and design students learn about financial goals, spending, money management, and other...

This is a detailed guide from the FCAC on how to read your credit report and understand your credit score. Building a good credit history is important for your financial health. Along with millions of other Canadians, you have a credit history that is kept on file by companies called credit...