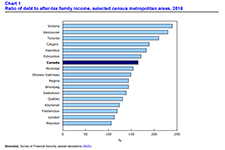

Canadian households are now deeper in debt than at any time since Statistics Canada began collecting debtor data in 1961. Debt, payment delinquency, and bankruptcy are increasingly a part of the lives of the young, the socioeconomically marginalized, and renters. This In-Brief explores the TransUnion dataset available through Winnipeg’s Community Data Consortium, including the spatial patterns of non mortgage debt, bankruptcy risk, and the back-end debt ratio in Winnipeg.

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth