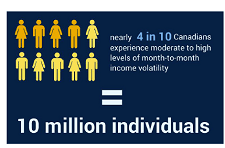

Income volatility describes income which is inconsistent (not received on a regular and predictable basis), unstable (amount varies each time it is received), and that fluctuates month to month by a significant percentage.

TD’s report, Pervasive and Profound, has found that Canadians experiencing income volatility are more likely to report feelings of financial stress and lower overall financial health. They are also significantly more likely to see themselves falling behind financially and much less likely to feel confidence in their financial future.

The survey findings show that income volatility is more likely to be experienced by part-time, self-employed, seasonal workers and the unemployed. The TD report uses Canadians’ reported behaviours and perceptions in the areas of saving, spending, borrowing and planning to gauge their overall financial health. In all four categories, those with higher income volatility show significantly lower financial health.