Who Doesn’t File a Tax Return? A Portrait of Non-Filers

The Canada Revenue Agency administers dozens of cash transfer programs that require an annual personal income tax return to establish eligibility. Approximately 10–12 percent of Canadians, however, do not file a return; as a result, they will not receive the benefits for which they are otherwise eligible. In this article, we provide the first estimates of the number and characteristics of non-filers. We also estimate that the value of cash benefits lost to working-age non-filers was $1.7 billion in 2015. Previous literature suggests either a rational choice model of tax compliance (in which the costs of filing are weighed against its benefits) or a more complex behavioural model. Our study has important consequences for policy-making in terms of the administrative design and fiscal costs of public cash benefits attached to tax filing, the measurement of household incomes, and poverty rates.

Medical-Financial Partnerships: Cross-Sector Collaborations Between Medical and Financial Services to Improve Health

Financial stress is the root cause of many adverse health outcomes among poor and low-income children and their families, yet few clinical interventions have been developed to improve health by directly addressing patient and family finances. Medical-Financial Partnerships (MFPs) are novel cross-sector collaborations in which health care systems and financial service organizations work collaboratively to improve health by reducing patient financial stress, primarily in low-income communities. This paper describes the rationale for MFPs and examines eight established MFPs providing financial services.

Food Insecurity amid the COVID-19 Pandemic: Food Charity, Government Assistance, and Employment

To mitigate the effects of the coronavirus disease 2019 (COVID-19) pandemic, the federal government has implemented several financial assistance programs, including unprecedented funding to food charities. Using the Canadian Perspectives Survey Series 2, the demographic, employment, and behavioural characteristics associated with food insecurity in April–May 2020 was examined. One-quarter of job-insecure individuals experienced food insecurity that was strongly associated with pandemic-related disruptions to employment income, major financial hardship, and use of food charity was found, yet the vast majority of food-insecure households did not report receiving any charitable food assistance. Increased financial support for low-income households would reduce food insecurity and mitigate negative repercussions of the pandemic.

Financial literacy and financial resilience: Evidence from around the world

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are financially literate—that is, they know at least three out of the four financial concepts. Women, poor adults, and lower educated respondents are more likely to suffer from gaps in financial knowledge.

Low Income Measure: Comparison of Two Data Sources, T1 Family File and 2016 Census of Population

This study looks at the differences in after-tax low income measure (LIM) statistics from two data sources which both use administrative tax data as their principal inputs: the 2016 Census of Population and the T1 Family file (T1FF). It presents a summary of the two data sources and compares after-tax LIM statistics by focussing on unit of analysis, LIM thresholds and the percentage of population below the LIM. The study also explores what factors users may want to consider when choosing one data source over the other.

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile. This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.

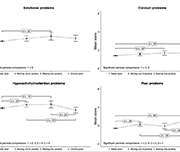

Economic volatility in childhood and subsequent adolescent mental health problems: a longitudinal population based study of adolescents

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in adolescence.

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

Financial Literacy of Indigenous Secondary Students in the Atlantic Provinces

Research conducted by agencies such as AFOA, Native Women’s Association of Canada, and various other Canadian entities, has identified the need for improved financial literacy education in Indigenous communities, particularly among youth and Elders. Such research reports are often equipped with a list of recommendations for improving and addressing the gaps in education around financial literacy. In the spirit of building upon this research into financial literacy and Indigenous peoples, the Purdy Crawford Chair in Aboriginal Business Studies (PCC) proposed a project focused on Atlantic Canada’s 14-18 year old Indigenous population and their levels of financial literacy. The results reveal that the majority of respondents would like to learn more about money. As well, they affirm that face-to-face learning from family members and in classroom settings remain the preferred way to learn about financial issues. Finally, based on the literature review, the environmental scan, survey data, and feedback from the community consultation process, a web application titled Seven Generations Financial Literacy was developed and is located at www.sevengenerationsfinancial.com.

Examining the Canadian Education Savings Program and its Implications for US Child Savings Account (CSA) Policy

This report analyzes the Canadian experience with education savings programs, as the US moves towards more comprehensive Children's Savings Account policy.

Caught in the Middle: Some in Canada’s Middle Class Are Doing Well; Others Have Good Reason to Worry