Financial Health & Wealth

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money. Money is a big way that others control and influence our lives. Sometimes we need to depend on others to give us money and tell us what to do with money. Opening a bank account, understanding where your money is coming from, and saving money will help you to become financially independent and financially healthy. This report from The Native Women's Association of Canada covers the importance of financial health and has sections on financial information covering bank accounts, insurance, budgeting, saving, credit cards, car loans, income taxes and housing.

Financial Literacy for Black and African American Students

In honor of Black History Month, BestColleges in the United States interviewed financial expert Terrance Dedrick to help curate a financial literacy resource for Black and African Americans. This article includes links to these organizations in the United States that cater to Black and African Americans: "Brown Ambition": A popular podcast for Black and African American students covers important financial literacy topics and provides advice from others who have learned financial literacy and used it successfully. Urban Wallet: A selection of free guides and resources to help students learn about spending and budgeting, investing in cryptocurrencies, and using credit cards responsibly. Association of African American Financial Advisors (AAAFA): for Black and African American students looking to work with a financial advisor to learn more about money. Operation HOPE: This nonprofit works with students and other adults alike to provide financial dignity through financial literacy training, coaching, and other services to build confidence and resilience. Building Bread: Designed for Black students and young professionals, Building Bread provides a free financial planning course along with other low-cost advanced classes.

Tips to keep your credit card safe

Your credit card can help you make purchases quickly without needing to have cash on hand. Follow these tips by the Ontario Securities Commission to use your credit card safely.

Cyber security & fraud prevention learning guide

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself, your family and your employees about cyber safety can seem overwhelming, but it doesn’t have to be that complicated and the CBA has developed a learning path to help.

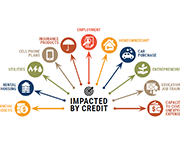

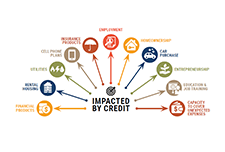

Advancing equity: the power and promise of credit building

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that anyone has access to credit and can build economic security, wealth, and intergenerational transfer. This brief will analyze what is not working within our credit system and identify what philanthropy can do to reimagine a system that builds economic security and mobility for everyone, especially people of color and immigrants. An equitable credit system would create pathways to narrow the racial wealth gap instead of continuing to widen it. Solutions include nonprofit organizations and community A webinar is also available and you can view the webinar slides here.

development financial institutions (CDFIs) delivering financial products that are designed for the people who have been most excluded from the credit system, seeding their journey toward economic security, as well as systemic changes to make economic security and mobility more fairly attainable.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

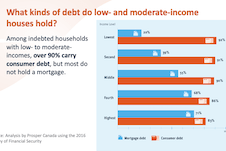

Report: Roadblock to recovery: Consumer debt of low- and moderate-income Canadian households in the time of COVID-19 (Prosper Canada)

Survey results: Canadians with incomes under $40K bearing the financial brunt of COVID-19 (Leger and Prosper Canada)

Time-stamps for the video recording:

4:42 – Agenda and introductions

7:52 – Audience polls

10:55 – Researching consumer debt (Speaker: Alex Bucik)

18:55 – How much does debt cost? (Speaker: Alex Bucik)

23:17 – How do different kinds of debt work? (Speaker: Alex Bucik)

29:17 – What are people using their credit for? (Speaker: Vivian Odu)

40:49 – What help is available to Canadian borrowers? (Speaker: Alex Bucik)

45:22 – Q&A

The Early Effects of the COVID-19 Pandemic on Credit Applications

This report documents the early effects of the COVID-19 pandemic on credit applications, which are among the very first credit market measures to change in credit report data in response to changes in economic activity. Using the Bureau’s Consumer Credit Panel, how applications for auto loans, mortgages, credit cards, and other loans changed week-by-week during the month of March, compared to the same time in previous years was studied.

Consumer Insights on Managing Spending

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In addition, we found that although most people would like to use budgets and plans, they often don’t use them to guide spending decisions in the moment. Budgeting and tracking spending are often considered to be overwhelming or too much of a hassle, and even those consumers who have a budget generally do not benchmark their spending to their budget frequently or regularly.

Handout 6-3: The cost of credit

This handout is from Module 6 of the Financial Literacy facilitator curriculum. The cost of credit for different payment methods.

Handout 6-2: Credit card features

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The features of credit cards and what they mean. To view full Financial Literacy Facilitator Resources, click here.

Handout 6-1: Types of credit

This handout is from Module 6 of the Financial Literacy Facilitator Resources. The different types of credit and their lending conditions. To view full Financial Literacy Facilitator Resources, click here.